Money & Markets

Melman on Gold & Silver

October 2018 by Leonard Melman

As mentioned last month in our “Final Thoughts,” we are now receiving a substantial amount of new information regarding the supply/demand fundamentals regarding gold and silver and we review some of that information below.

As long term readers know, one of the subjects we have avoided as much as possible during the three decades (and more) of this column is the world of partisan politics. However, during the past few weeks, politics has begun to dominate the public media to an extent seldom scene, and we believe the observed level of animosity could have a direct effect on our world of gold and silver.

First, we note the upcoming “mid-term” election scheduled for Tuesday, November 6—or about one month after your receipt of this edition. Many observers are calling this the most important election in a lifetime—mid-term or Presidential. The reason is simple enough: the belief that it will be an advance referendum on what may be called the “Trump Revolution.”

At present, the Republican Party holds a modest majority in the House and a minimal majority in the Senate. Therefore, given the normal pattern of the party in power losing some seats at mid-terms, the potential for dramatic changes in party standings is significant.

The gulf between the two sides has become enormous—and vitriolic—as we are seeing hate-filled rhetoric on an almost unprecedented scale, presumably because there is so much at stake. Those who support the President fear the loss of majorities in both the House and Senate could lead to both the attempted impeachment of the President and the virtual cessation of his initiatives. Those supporting the Democratic Party fear if the Republican Party remains in power, that event would mean the continuation of policies to which they are bitterly opposed.

The gulf between the two sides has become enormous—and vitriolic—as we are seeing hate-filled rhetoric on an almost unprecedented scale, presumably because there is so much at stake. Those who support the President fear the loss of majorities in both the House and Senate could lead to both the attempted impeachment of the President and the virtual cessation of his initiatives. Those supporting the Democratic Party fear if the Republican Party remains in power, that event would mean the continuation of policies to which they are bitterly opposed.

Therefore, the struggle is taking on overtones that might even be described as “ugly.” Hence, we believe the result could impact the world of gold and silver in several manners, and we review that discussion below.

And, of course, we also take a look at the President himself and note some of the more virulent attacks against him and the supportive statements of some of his advocates.

On a lighter tone, we came across one of those serendipitous stories that can occur from time to time in both hard rock mining and in prospecting. We will describe that happy event below.

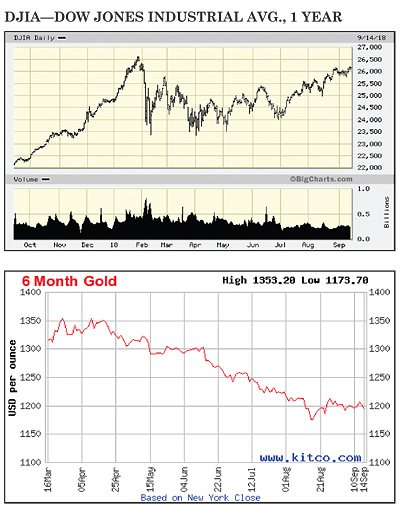

In the meantime, we note the general stock market has been able to hold near all-time highs (see Dow Jones Industrials 1-year chart), once again rising above the 26,000 mark.

The strength of the American economic data for the past month has been truly impressive. Among the headlines we have noted are: “US business creation hits record high;” “Job openings exceed unemployed Americans again in July;” “Jobless claims remain at half-century low;” “Strong economy drives wages higher in August;” “US worker productivity rose in spring at best pace since 2015;” “US 2Q GDP growth revised upward to 4.2%;” “Americans haven’t been this confident in the economy since 1990s Internet boom;” and “US retail sales rise at 6.0% annualized rate in July.”

On the opposite side, we noted only two major negative economic headlines that were “July new-home sales suggest sluggish summer” and “US consumer sentiment soured in August.”

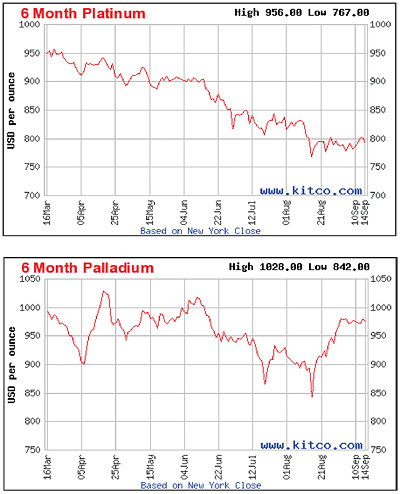

Gold, silver and copper all showed declines last month, with silver leading the way down, falling from $14.80 to just above the $14 mark, thereby making a significant multi-year low (see 5-year chart) while gold and copper fell moderately. Many of our shares showed outsize losses and minus signs predominated in our “monthly change” column.

_______________

_______________

Fundamental information on gold and silver turned more to the bullish side this past month, and we can point to three particular items as the basis for that conclusion.

First, the most important single demand factor—that of the enormous Indian gold market—appears to be strengthening. A recent study published by Thomson Reuters pointed out that, “India is likely to help gold recover its lost sheen as reinforced by recent data from the country.”

The report goes on to tell us that in addition to rising demand for gold for weddings and other celebrations, a long-term trend in favor of gold is defined by the gradually rising incomes of India’s middle class.

We are also told that demand for gold in India normally rises during the second half of the year and into January of the next year.

At the same time Indian demand—the largest in the world—is expected to rise, S&P Market Intelligence reports that, “Gold output in key countries to slump to ‘generational’ lows.” The article refers to production from major mining countries such as Australia and Peru. What we found to be of great importance was the article declaring that significant declines into 2020 and beyond are now being forecast.

Canada was identified as a particularly negative case regarding long-term precious metals production. They noted, “Much of Canada’s near-term production is coming from discoveries made in the past 25 years… At the same time, discovery rates have fallen…”

The S&P article then summarized, “S&P expects output this year from current operations to fall short of 2017 production by as much as 3% and by almost 15% by 2022…”

As an additional reason for some optimism regarding future price movements for gold, noted Australian analyst Steve Saville just wrote in mid-August, “For the first time this year, about two weeks ago the sentiment backdrop became decisively supportive of the gold price and remains so…”

Obviously, the most important information will come from price movements themselves, but we now are able to declare that a shift toward the positive in terms of relevant information for the precious metals may indeed be building.

_______________

To state that a titanic battle is looming within American politics would be a drastic understatement for on November 6, 2018, Americans will go to the polls to elect all Representatives and one-third of the Senate for the coming two-year period. And, while the President is scheduled to retain his office until the election of 2020, there are those who believe that a Democratic victory in both houses could lead to an attempt at impeachment, successful or otherwise.

To state that a titanic battle is looming within American politics would be a drastic understatement for on November 6, 2018, Americans will go to the polls to elect all Representatives and one-third of the Senate for the coming two-year period. And, while the President is scheduled to retain his office until the election of 2020, there are those who believe that a Democratic victory in both houses could lead to an attempt at impeachment, successful or otherwise.

What makes this campaign unusual is the bitterness involved and it is objectively fair to note that the worst examples of invective have come in the form of attacks on the President from the political Left. As examples, we have heard profane threats to beat him into the ground, wishes to bomb the White House, carrying of an effigy of a severed Presidential head, pleas for a re-enactment of an assassination in the White House and a host of similar threats too numerous to mention.

We have also seen the publication of a controversial volume pillorying the conduct of the President written by noted journalist Bob Woodward as well as the recent publication of an anonymous letter-to-the-editor published in the New York Times clearly designed to ridicule and embarrass the President.

From the President’s side, many of his supporters and several noted media personalities have carried on a campaign assailing former President Obama’s appointees and confederates of carrying on a “witch-hunt’ against the President, using Obama holdovers in the highest ranks of the FBI and Department of Justice. Their claim is that immoral and perhaps even illegal means have been used to submit the main controversy, which is collusion with Russian agents during the 2016 campaign, to the investigation of a special team headed by former FBI chief Robert Mueller.

These varying accusations and counter-accusations will go down as perhaps the most bitter such events in American political history.

What is notable from the mining and prospecting point of view is that the attacks against the President have emanated from the political Left and the fear is that if that side emerges victorious, America will take a strong turn toward government by enhanced regulations, particularly those involving the environment, and that could have a significantly negative impact on the cost structure of mining developments, particularly during the already expensive exploration and development phases.

Specifically, there is concern that given President Obama’s declaration that “Global Warming” constituted the greatest threat to humanity, if his supporters and advocates take over control of the US government, there will be no limits at all on the potential for drastic and dramatic measures being taken to “save the planet.” If that proposition turns out to be true, this should truly concern miners and prospectors.

It is that important.

_______________

Of course, standing at the very heart of this looming struggle is the President himself, Donald J. Trump, and it is clear that love him or hate him, he has stood front and center at the core of virtually every political controversy of the past three years.

After years of publicity as a media personality who made the phrase “You’re Fired!” part of the public discourse, he made the decision to enter the Republican Presidential race in 2015. From that point forward, he has exceeded predictive outcomes by first winning the Republican nomination over 16 other candidates and, of course, by winning the Presidency over highly-favored Hillary Clinton.

His opponents have created a virtually endless list of accusations to hurl against him including his accusations of bias against a Latino judge, his ill-chosen words regarding a Muslim “Gold Star Mother” whose son died while serving in the military, his presumed one-night stand with a prostitute, and, of course, the accusations—endless in nature—that he stole the election by collaborating with Russians.

On the other hand, his supporters can point to significant progress in diminishing hostilities between North Korea and America, removing America from the possible regulatory nightmare represented by the Paris (environmental) Accord, removing America from the controversial Iran Treaty, moving the American Embassy in Israel from Tel Aviv to Jerusalem, and, perhaps most important, presiding over a host of improving economic indicators which they claim have improved the lives of millions of Americans.

Both sides are entrenched and will not willingly yield a proverbial inch in order to achieve some sort of compromise to reduce political tensions—and that makes us wonder what kind of America will emerge following November 6.

In terms of gold and silver, we believe the ultimate question is whether it will be an America on the way to restoring tranquility and peaceful discourse—presumably negative for the precious metals—or whether hostilities will reach a boiling point, perhaps even leading to rampant violence in the streets—which presumably would be positive for the precious metals.

And we have only a few weeks until the election takes place!

_______________

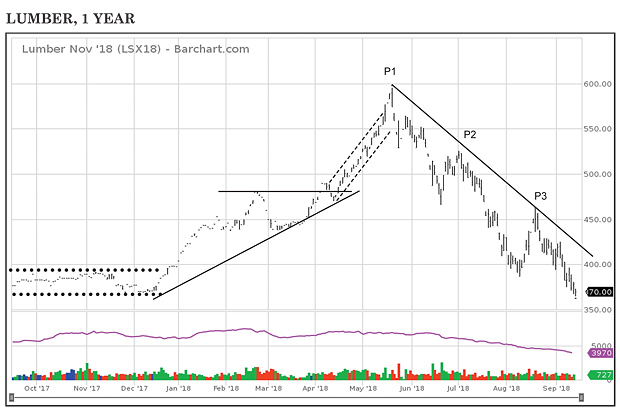

Chart Analysis—Lumber, 1 Year

One of the most important industries in America is building construction and, quite obviously, a vital segment in that field is residential home construction. Accordingly, an examination of the trading chart of Lumber can often provide us with important economic information.

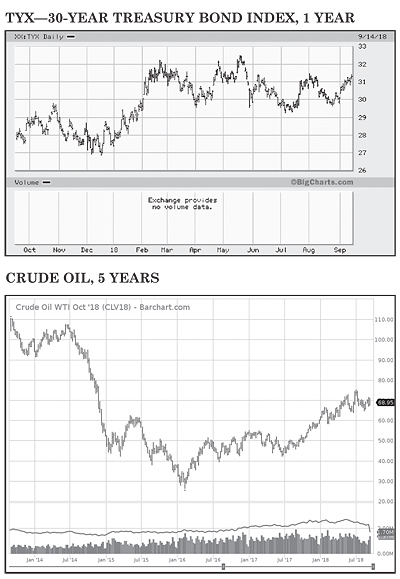

The situation in Lumber appears to be particularly relevant in this time frame, because some clear negative chart indicators seem to be at odds with the general economic background. As noted in our introduction, numerous economic indicators are providing truly optimistic data and, as indicated by our chart of the TYX Index, which indicates rates on 30-year government bonds—those rates which directly affect mortgage lending—are holding steady. Both should be providing support for strong housing construction demand into the future, and yet, since late May, Lumber has been in steep decline.

Lumber held relatively steady just inside a trading range from $360-390 (parallel dotted lines) through the last three months of 2017, beginning a sharp advance to $450 before consolidating and then rising to a new peak at $480 with the entire pattern forming a bullish “rising upsloping right angle triangle” (solid lines) which ultimately broke to the upside.

Lumber held relatively steady just inside a trading range from $360-390 (parallel dotted lines) through the last three months of 2017, beginning a sharp advance to $450 before consolidating and then rising to a new peak at $480 with the entire pattern forming a bullish “rising upsloping right angle triangle” (solid lines) which ultimately broke to the upside.

Lumber then traded inside a rising channel (dashed lines) before reaching its chart peak at “P1” near $600.

Lumber then entered a period of decline, leaving behind a bearish pattern of “declining” peaks, which we have noted as P1, P2, and P3, with the decline taking place beneath a steep downtrend line (solid line). It is also interesting to note that the recent declining portion of the chart forms an almost perfect “mirror image” with the January-June rally. If that image holds, we should now expect some consolidation in the $370-390 level.

In any case, a decline of $225 ($600-$375) is sufficiently large to cast doubt on the sustainability of the recent construction boom. Present support now comes in between $350 and $390, while overhead resistance can be found near the $450 mark. Those are the levels we will be closely watching.

_______________

_______________

Our “World of Gold” indicators are as follows:

(Note: A “Positive” rating means the situation is beneficial for precious metal prices.)

INFLATION—Remains POSITIVE. Overall inflation readings continue to hold near 3%, the highest level in several years. In addition, for all the reasons noted in our introduction, the American economy continues to build inflationary pressures, particularly on the labor front. Also, our long-term chart shows the price for Crude now appears ready to continue the general uptrend that began following the lows near $30.

INTEREST RATES—Remains NEUTRAL. Our TYX chart of 30-year Treasury bond interest rates remains constant just above the 3% mark, while short-term interest rates hover near 2%. For the longer term, however, the Fed is now signalling that it may be ready to raise rates over the coming year in order to combat possible inflation, but for the moment, there is little immediate significant action.

INTERNATIONAL TEMPERATURE—Changes to NEUTRAL. There has been a noticeable diminishment of conflicts on the world stage during the past month, perhaps due to the sharp focus on the upcoming US elections. At least temporarily, North Korea and Israel/Arab neighbor tensions have abated.

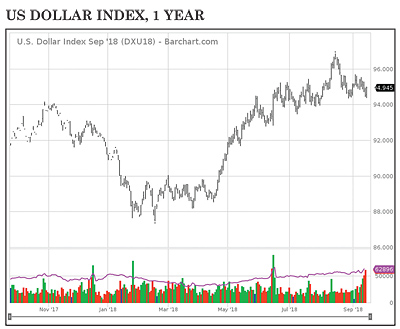

US DOLLAR—Changes to NEUTRAL. As noted last month, the DX Index rose above the 96 level, appearing to be headed higher, but then made a quick U–turn back to below 95 (see chart), thereby returning to “Neutral” territory.

US POLITICAL CONFIDENCE—Remains POSITIVE. Not only does the public remain highly skeptical regarding Congress’ ability to resolve serious problems, but the level of conflict between various segments of the American political public has reached exceedingly high levels, a condition that appears likely to continue far into the future, regardless of the outcome of the approaching election.

US ECONOMIC TEMPERATURE—Remains POSITIVE. New employment data could be indicating the early stages of a significant wage-price spiral as labor shortages begin to appear in many industries, putting upward pressure on wages across the employment spectrum.

US ECONOMIC TEMPERATURE—Remains POSITIVE. New employment data could be indicating the early stages of a significant wage-price spiral as labor shortages begin to appear in many industries, putting upward pressure on wages across the employment spectrum.

WORLD’S STOCK MARKETS—Remains NEUTRAL. By and large, major markets in cities such as Tokyo, Frankfurt, London, Paris, Seoul and Milan have remained near the middle of their yearly range, failing to follow the Dow and S&P 500 in their recent rallies.

GOLD’S TECHNICAL POSITION—Remains NEUTRAL. While both the short-term and intermediate-term gold charts continue to show negative trends, by holding above long-term support between $1,050 and 1,150, gold continues to avoid a long-term sell signal. Chart resistance overhead can now be found between $1,300 and 1,400.

TOTAL SCORE: Positive, 3; Negative, 0; Neutral, 5.

_______________

The “serendipitous” story we referred to in our introduction comes to us from Australia.

Toronto-based Royal Nickel Co. had purchased a depleted nickel mine which they then put up for sale—but the mine failed to attract any buyers. Perhaps Royal Nickel now finds that to be a “blessing in disguise” because some of its employees, while exploring just below the depleted nickel ore body, came across an astonishing find. As the Financial Times noted, they came across, “...a single cube of earth that measured roughly three meters high by three meters wide by three meters deep containing 9,000 ounces of gold worth about $11,000,000 at current prices.”

Nice to know that good things can still happen within our world of gold and silver.

_______________

Final thoughts:

One of the outcomes of the coming elections I find to be of vital consideration is the history of what might be termed “over-regulation.”

Historically, the political Left has tended to create significant bodies of regulatory law, particularly in those matters involved in environmental law, while the political Right has tended in the opposite direction. As far as both prospecting and hard-rock mining are concerned, the attitude has been to let the market prevail and keep regulations to a minimum. Therefore, there appears to be a vested interest from both mining camps in the outcome of this election.

Next month we plan to write about the potential election results as well as to discuss some of the specific types of laws that could hang in the balance.

Until then, happy prospecting and good luck!

A Primer on Bitcoin and Other Cryptocurrencies—Part II

We’ll conclude by digging a bit more into the regulations and pitfalls, and discuss what they are used for, their relationship to gold, and what the future holds.

Melman on Gold & Silver

…there is now concrete evidence that growing numbers of investors and other concerned observers are now turning to gold as a storehouse of value in these potentially troubling times.

Mining Stock Quotes and Mineral & Metal Prices

Melman on Gold & Silver

I find it difficult to recall a period when the world has encountered so many simultaneous threats which “should” have driven gold and silver higher, and yet the precious metals markets—so far—have failed to rally to any significant extent.

Melman on Gold & Silver

Somehow, we received the impression from these two gatherings and from other conversations that bureaucrats in general are simply not aware of how difficult it is to raise capital to finance mining operations and how important it is for newer companies to show true progress in order to receive further financing.

Subscription Required:

Free:

The Bawl Mill

• Legislative and Regulatory Update

• Ask The Experts - A few questions about 'peak gold'

• Ask The Experts - Seeking advice on processing pocket gold

• Ask The Experts - How do I recover gold in pyrite?

• Ask The Experts - Can a British citizen purchase a mining claim?

• Ask The Experts - Is California dredging going to return in 2019?

• Ask The Experts - Were you aware of the new recording fee in California?

• The Unusual Forest Nugget Patch

• California Sniping

• Large Gold Deposit Types

• PLP Update

• A Father’s Day to Remember: 24,000 Ounces Gold in Quartz

• How to Beat the Heat--and The Bedrock

• Gold Prospecting: For Better or Worse--It Was A Dark and Overcast Night

• Using Geologic Publications to Discover Collecting Sites

• Prospector Unearths Huge 'Duck’s Foot' Nugget

• Mining Stock Quotes and Mineral & Metal Prices