Large Scale Mining

A New Look at Old Mines

April 2011 by Chris Ralph

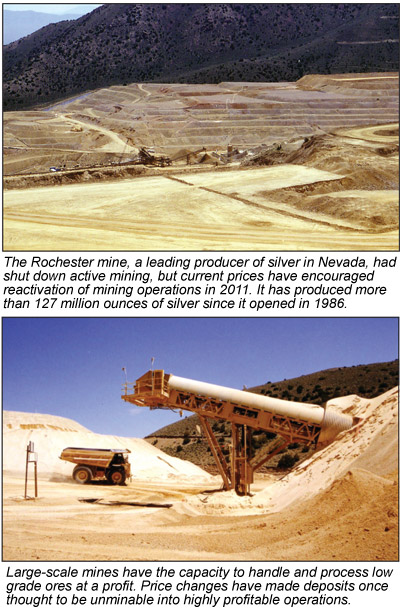

Record high precious metals prices have been prominent in virtually all forms of the news media in recent months. While many folks are looking to accumulate metals for themselves, these price changes are starting to produce a revolution in the precious metals mining industry. Elevated values are completely turning over the economics of gold mining around the world and creating new opportunities for gold prospectors and precious metals exploration companies. Gold and silver mining has never been easy, but the significant price increases of the past year have changed the concept of what ores can and cannot be profitably mined. Geologists and prospectors around the world are now moving quickly to take a new look at old mining properties once thought too low in grade to work as potential new sources of gold and silver.The exploration boom of the 1980s and 1990s identified many rich new properties, but there were also a good number of low grade marginal properties in the western US and elsewhere. A fine example is the Goldbanks mine p

roperty in Pershing County, Nevada. Nearly put into production more than a decade ago by Kinross, initiation of production at the property was delayed and never actually started because of various reasons, mostly due to the low price for gold at the time. Falling prices sunk the project before it could get off the ground as the generally low grade of the deposit, combined with a poor outlook for gold prices, resulted in the project being deemed unprofitable at the time. The ore remains in place and it is still a well-identified resource that is now far more attractive given the current prices of precious metals.

roperty in Pershing County, Nevada. Nearly put into production more than a decade ago by Kinross, initiation of production at the property was delayed and never actually started because of various reasons, mostly due to the low price for gold at the time. Falling prices sunk the project before it could get off the ground as the generally low grade of the deposit, combined with a poor outlook for gold prices, resulted in the project being deemed unprofitable at the time. The ore remains in place and it is still a well-identified resource that is now far more attractive given the current prices of precious metals.The Pan deposit in White Pine County, Nevada, which is now being moved toward production by Midway Gold Corp., is another example of this type of situation. These examples are not just isolated unusual occurrences because a considerable number of similar lower grade properties also exist in many areas.

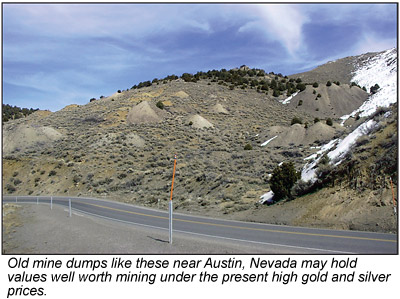

In addition to resources that were just never put into production, there are also many other projects that were mined during the same time frame but left behind large halos of lower grade material that were unprofitable to work at the time. Gold-bearing rock encircling these older pits may also now be of interest. Both the Hog Ranch and Wind Mountain properties in Nevada come to mind as examples of this type of situation. Even old heap leach piles, which were originally worked using uncrushed run-of-mine ore, may be economically removed, crushed and re-leached with the extra recovery from crushing paying for the costs of processing with a tidy profit left over. Even old low grade dumps may be of interest for processing under current conditions.

Consider this example of the simple economics that today’s higher metal prices offer: Using ballpark numbers for heap leach projects from the 1990s, a typical cost would be something in the range of $3 per ton to mine and process ore, and $1.50 to dig and dispose of waste. We can use as an example a low grade ore grading 0.03 ounces of gold per ton that has a recovery rate of 65% from heap leaching and requires 3 tons of waste to be moved for each ton of ore produced. With our ballpark costs and the example low grade ore numbers, it’s easy to show that at late 1990s prices it would not be economic to mine that ore. It would cost $7.50 per ton to mine and process the ore as well as move the necessary waste to access it, yet at $350 per ounce it would yield only $6.82 for 0.03 ounces of gold. Working that ore would be a money-losing proposition.

While this was just an example, the economics of the time were very real, and many gold mines working lower grade ores were shut down in the 1990s when gold dropped below $350 per troy ounce.

Let’s take a look at this same example using current prices and see what a difference adding $1,000 per ounce to the price of gold can make. Today’s mining costs would be a bit higher, so equivalent costs might be on the order of $5 to mine and process ore, with $2.50 needed to dispose of waste rock. Yet, in spite of higher costs, the economics are totally different. The same low grade ore would now cost $12.50 to mine and process, but at $1,350 per ounce it would yield $25.35, providing a generous profit of nearly $13 per ton. No question that making a profit of nearly $13 per ton is a whole lot better than losing about $0.70 for each ton. Multiply this by the typical production rate of a big open pit mine that would be handling many thousands of tons per day and

you get a feel for why these new prices are creating such a rebirth in the mining industry. Given the proper leach and stripping characteristics, ores as low 0.007 ounces per ton, often considered as waste in the past, may be profitable to mine. It is this type of major change in the economics of low grade ore that has geologists all across the world scrambling to review old data on low grade deposits, as well as the lower grade halos surrounding previously mined deposits and the down dip extensions of previously mined deposits that were thought to be too deep to pay for the costs of overburden stripping.

you get a feel for why these new prices are creating such a rebirth in the mining industry. Given the proper leach and stripping characteristics, ores as low 0.007 ounces per ton, often considered as waste in the past, may be profitable to mine. It is this type of major change in the economics of low grade ore that has geologists all across the world scrambling to review old data on low grade deposits, as well as the lower grade halos surrounding previously mined deposits and the down dip extensions of previously mined deposits that were thought to be too deep to pay for the costs of overburden stripping.This same concept applies not only to large scale open pit mines, but to smaller commercial placer mines as well. Gravels that were previously unprofitable are now in many cases potentially very worthwhile to mine. As a result, operations given up long ago as money losers now have the capability to yield handsome returns. Many placer operators are also re-evaluating any old properties with identified low grade resources. As placer operations are generally a lower cost to capitalize, many smaller operators are focusing on these opportunities. In fact, many folks not previously involved in gold mining are even considering this option, as demonstrated on a recent popular TV reality show about inexperienced placer miners in Alaska.

Since this whole effect of making low grade material profitable is based on elevated metals prices, one wonders how long will these high precious metal prices last. Could they just be a temporary flash in the pan? While they seem fairly stable at the present time, no one really knows for sure. If the price does stay high, its likely the coming years will bring increases in gold and silver production as some of these lower grade operations come on line. I had an old professor who used to say that nothing cures high prices like high prices. What he meant was that high prices attract new production, leading to a drop in those same high prices. It’s just the action of basic economic theories of supply and demand. New supplies come onto the market and meet the needs of excess demand, resulting in a drop in prices.

Yet the economics of gold are a lot different than they were in the 1980s and 1990s. During those times, many governments and related agencies like the International Monetary Fund were pumping large amounts of gold onto the world market. Gold was seen by many as a relic of the past—an inferior asset that yielded no interest and cost money to store. It was thought that it was best to get rid of it and at least get some cash that could be used or loaned out. Great Britain, once a large holder of gold, sold nearly every ounce it had. These actions seemed sensible to some at the time. The runaway inflation of the 1970s had been stopped, the dollar was king, and most governments were behaving responsibly with their currencies. Only banana republics headed by crazy dictators would be irresponsible enough to manufacture money out of thin air, leading to runaway inflation. The huge amounts of gold that were dumped onto the market by government sources, together with new production from operating mines, greatly depressed prices; gold spent years languishing at less than $350 per ounce.

Fast forward to the present time, and the idea of simply manufacturing large amounts of money has become something that our federal government does on a large scale and is seen by some economists as a wise practice. A number of governments now use techniques to intentionally depress the price of their currencies so that they can increase exports. Some have termed it a currency war or the “race to debase” (their currency). Each time a government manufactures money out of thin air, the value of their currency is automatically worth a bit less than it was before. To protect assets from this backhanded form of devaluation, both individuals and governments are now buying gold.

In the 1980s and 1990s governments were huge net sellers of gold, but things have changed and now they have become significant net buyers of gold. Individuals, fearing the consequences of reckless spending and unending money expansion have looked to gold, silver and other precious metals as an important store of wealth. These metals have become an alternative form of currency that is safer because no government can simply create gold out of thin air. The fundamentals of today’s gold and silver markets seem to promise even more strength than the precious metals markets of the late 1970s and early 1980s. So it appears that strong precious metals prices are not just a temporary blip on the world radar because changes in both government and investor demand for them means they will be with us for a while.

What can prospectors focus on to unlock this new opportunity and find these kinds of deposits? Look to regions where gold has been produced in the past and search for locations that may have been drilled previously but given up by the former operators as too small and too low in grade to be worthwhile. Old reports and industry records list past exploration drilling campaigns, including the unsuccessful ones. While few deposits of this type are likely still open to claim, there may still be a small number. Sometimes past exploration firms gave up on deposits of low grade ore without thorough drilling and testing simply because the marginal grades seemed too low to be worth pursuing or the exploration company found it difficult to raise additional funds based on seemingly uneconomic results. Those with only a few low grade holes are the ones most likely to be unclaimed.

Sometimes additional low grade deposits will line up along a fault zone on trend with known or previously mined deposits, especially in areas with similar geology to the known deposits. A soil sampling program may indicate unusual concentrations of gold or silver or pathfinder metals such as arsenic, antimony or mercury. Every district has its own unique characteristics, and it’s worthwhile to study the geology and structural controls that have formed valuable deposits. Those that understand the geology of the regions they are exploring will have a distinct advantage in their search.

Exploration companies are actively looking for properties with profitable potential, even if the ground was once cast off as too low in grade to be economically viable. This is especially true in states that are reasonably friendly toward mining and deposits in stable countries like the US, Canada and Australia are the most desirable. Smart prospectors will be out taking a look at the potential ground that just might meet those needs, find those opportunities and market their properties to the mining firms seeking favorable locations to explore.

New Technology for Extracting Lithium To Be Tested in Nevada

Production of the Lithium will be completed in a 48-hour process with much less waste and a substantial increase of recovery rates from around 40% with conventional evaporation to near 90%.

Prospecting for Copper Ores—Part I

Copper is one of the metals that form the backbone of our modern civilization. Copper is an essential part of every computer, cell phone, automobile and household appliance.

Copper is one of the metals that form the backbone of our modern civilization. Copper is an essential part of every computer, cell phone, automobile and household appliance.

Gold Ores of the Delamar District, Nevada

Even as late as 1906, Delamar was second only to Tonopah and Goldfield in production outshining many better known areas. Since the first discoveries, more than 700,000 ounces of gold have been produced from the mines here.

Even as late as 1906, Delamar was second only to Tonopah and Goldfield in production outshining many better known areas. Since the first discoveries, more than 700,000 ounces of gold have been produced from the mines here.

Silver Peak, Nevada: A Little of Everything

Silver Peak is a small mining community in Esmeralda County in west-central Nevada, about 30 miles west of Goldfield. Although it’s fairly remote, it’s been an important mining center since the early days.

Silver Peak is a small mining community in Esmeralda County in west-central Nevada, about 30 miles west of Goldfield. Although it’s fairly remote, it’s been an important mining center since the early days.

An Update On The Father's Day Gold Discovery

Just recently, the miners hit another big pocket, this time with nearly 1,000 ounces of gold. Some of the rich specimens were as big as a fist and others were in the form of smaller pieces.

Just recently, the miners hit another big pocket, this time with nearly 1,000 ounces of gold. Some of the rich specimens were as big as a fist and others were in the form of smaller pieces.

Partner Withdraws from Pebble Project

One of the partners in a massive and contentious proposed gold and copper mine in Alaska is pulling out, raising questions about the future of the project.

Subscription Required:

The Bawl Mill

• Mining Claims—What to Know Before You File

• Prospecting Underground: Use Caution

• Small-Scale Concentrating and Recovery Methods

• 5th Circuit Ruling May Benefit Miners

• Indicator Minerals for Gold & Silver

• Mud Men: Pocket Miners of Southwest Oregon Part III

• Legislative and Regulatory Update

• Melman on Gold & Silver

• Mining Stock Quotes and Mineral & Metal Prices

• Silver Mining Returning to Texas