All Articles

Melman on Gold & Silver

February 2010 by Leonard Melman

Here we are, well into the new year and decade, but it seems that recent events continue to bear a strong resemblance to those of the year and decade just concluded.For example, President Obama continues to press hard for the enactment of a major medical insurance bill, he has just succeeded in getting a major “job creation bill” passed and, in general, the tide toward complex government interventions into economic, taxation and social matters continues unabated (see discussion below).

China clearly remains the focus of the world’s attention in terms of economic expansion, which many hope will eventually provide the basis for a long-lasting, non-inflationary new era of prosperity for the international economic community. We take a closer look at China below.

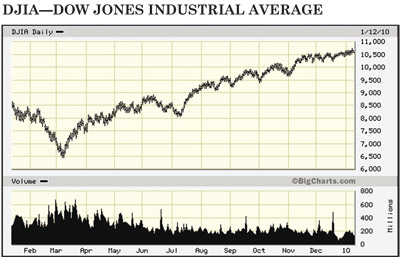

America’s financial markets continue to struggle higher (see Dow Industrials chart) as domestic economic data finally has begun to take what appears to be a solid turn to the upside. While there is strong debate regarding the sustainability of this improvement, there is no question that, in general, economic performance has finally begun to climb out of the basement.

However, most of the headlines generated in late December and early January came from two widely divergent sources. First we saw the international conference on climate change in Copenhagen, attended by virtually every world leader and followed closely by the international news media. However, after several days of “sound and fury” the only item of agreement turned out to be an agreement to meet again. Of course, the cloud that hung over the conference was the disclosure of emails sent between advocates of the “Global Warming” theory that brought into question the manner in which pro-Global Warming scientific data had been gathered, protected and distributed.

The other incident was an attempted sabotage of a Northwest Airlines flight from Amsterdam to Detroit, an attempt that almost succeeded. Since that time, there has been a frenzied step-up in airport security measures—including virtually nude scanners—which have inconvenienced the public to an unprecedented degree.

Economic data has shown some identifiable improvement in recent weeks and months. Amongst the positive data we find the Institute for Supply Management (ISM) Manufacturing Index rising to 55.6 for December, the highest level since April 2006; Personal Income gaining 0.4% for November; Existing Home Sales ahead by a strong 7.4% for November; the Index of Leading Economic Indicators ahead by 0.9% for November and the Conference

Board’s Consumer Confidence Index rising from 50.6 in November to 52.9 for December.

Board’s Consumer Confidence Index rising from 50.6 in November to 52.9 for December.Negative figures can still be found, particularly those related to the non-farm job market, which lost another 85,000 positions in December according to the Department of Labor, while the Unemployment Rate held firm at 10%. We also note that the commercial real estate world remains troubled as Construction Contracts during November fell by almost $40 billion from the preceding month.

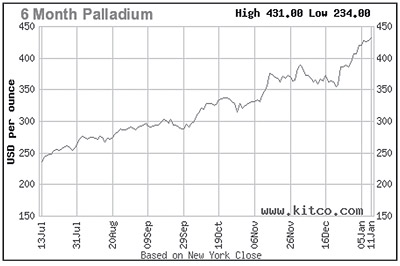

Base metals markets performed particularly well from mid-December through presstime with copper rising from near $3.10 to a recent peak at the $3.50 level, and comparable figures for nickel, zinc and lead, respectively, are $7.50 to $8.50; $1.05 to $1.20 and $1.03 to $1.18. Gold has rebounded to near $1,160, silver to just under $19.00 and platinum broke through the $1,600 level. Not surprisingly, many mining shares on our lists have shown solid gains during the past month.

One last note of interest regarding gold is the rising popularity of “turn in your gold” house parties. Representatives from gold refineries are hosting parties where attendees are encouraged to turn their gold jewelry into cash, and many consumers are taking advantage of this opportunity. For a contrarian, the public’s willingness to get rid of its gold (at below market prices) could easily be interpreted as a positive indicator for the yellow metal’s future.

_______________

Every so often we come across a quote from a famous person that is so prescient, so full of meaning and so applicable to our world of today that we feel compelled to share it with our readers. Please note the following from one of America’s earliest Presidents, James Madison, written in The Federalist Papers more than 200 years ago...

“It will be of little avail to the people that the laws are made by men of their own choice, if the laws be so voluminous that they can not be read, or so incoherent that they can not be understood; if they be repealed or revised before they are promulgated, or undergo such incessant changes that no man who knows what the law is today can guess what it will be tomorrow.”

This quote struck home as your columnist attempted to peruse the full contents of such legislation—proposed or already enacted—as the 2,300 page Clean Air and Safety Act, this year’s stimulus bill, the presently-under-consideration revision of the 2,000-plus page proposed medical insurance bill—or any of the other laws that are complex and lengthy, almost beyond measure.

It is also worth noting that new proposals for legislation continue to pour forth, including such items as “job creation” bills, bank reform bills, new curbs on pay bills, Federal Trade Commission expansion bills, and so forth. In addition, there are so many discussions regarding new taxation measures that it is difficult to keep track, but here are just a few: Taxation on foreign holdings; taxes on tanning salons; new taxation fees against banks; new estate tax measures; new taxes on financial transactions; new environmental taxes; new medical insurance company taxes; new taxes on drug makers and medical device manufacturers—and the list truly goes on and on.

In fact, the expansion of government in Washington has accelerated to the point that the demand for office space in the DC area by government, lobbyists, and others has driven commercial real estate rates in that city to the highest level in America, outstripping even New York City, which had been the holder of that title for many decades.

We believe there is a relationship between this very manner of action against which Madison issued such a clarion warning and the price of the precious metals, particularly in the long run. As laws become cluttered, difficult to understand and almost impossible to enforce both effectively and economically, they are bound to drag down industry and commerce inside a welter of complications. Then, as the enterprises of the nation see their ability to generate profits diminish, all manner of negative economic consequences such as rising unemployment and falling tax revenues begin to take place, thereby likely exacerbating items such as towering deficits, towering debts and massively increasing borrowing requirements—all of which, in our opinion, will put additional downward pressure on the American Dollar—to the ultimate benefit of gold, silver and platinum.

_______________

Economic data continues to suggest that China is growing ever-more important as a center of influence in the world’s economic affairs and, along with that economic strength, political independence and prestige also appear to be increasing. Evidence of the latter consideration has just come in the form of China’s refusal to join in sanctions against Iran’s growing nuclear activities.

Some of the recently released data has been truly impressive. For example, China has just surpassed Germany as the world’s leading goods exporting nation, with exports in the first 10 months of 2009 totaling $957 billion versus Germany’s $917 billion. In terms of overall GDP, China passed Germany to take over third place in world rankings in 2007 and is expected to pass Japan and move into second place in the near future.

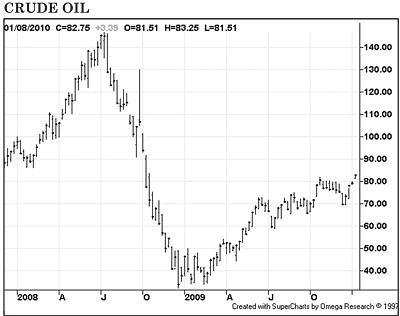

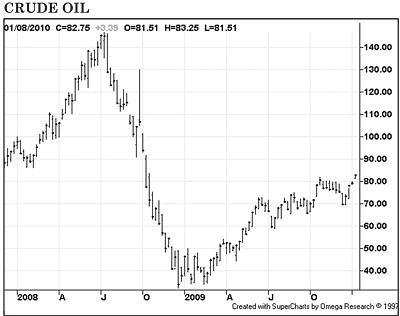

China’s auto industry continues to expand, putting upward pressure on oil consumption (see crude oil chart) as well as increasing demand for other raw materials such as steel and copper. General Motors just reported a whopping 67% gain for their Chinese sales and we have also learned that overall Chinese auto sales reached the 13 million level during 2009, far surpassing new auto sales in the USA.

As their economy has grown and as trading surpluses have expanded, so have China’s holdings of foreign debt. In particular, we observe that Chinese ownership of US government debt paper is now approaching $1,000,000,000,000—or one trillion dollars. As China accumulates Dollars, they are able to exert greater and greater influence on American fiscal policy since China now has the ability to send the US Dollar into a virtual death spiral should they decide to convert those US debt holdings into gold, Euros or other currencies. In fact, they have already taken actions to diversify some portion of their wealth by purchasing huge quantities of gold at International Monetary Fund auctions and by pressuring OPEC, the UN and other international bodies to consider pricing petroleum in units other than the US Dollar.

China is on the move and, as it relates to both fundamental demand for raw materials and monetary considerations, its potential influence on the mining and metals investment world can hardly be over-emphasized.

_______________

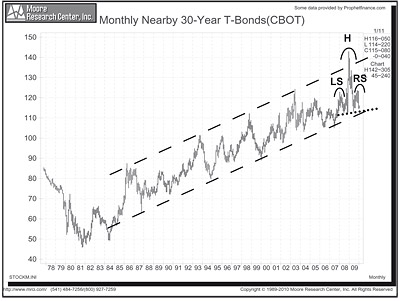

Chart Analysis—Long-Term Treasury Bonds

Perhaps the most important single reflection of government financial policies can be found in the 30-year T-Bond Chart, which (inversely) reflects the interest rate on 30-year Treasury Bonds—and the chart is telling us a most interesting story at this time.First, consider a bit of history. During the inflationary crunch of 1979-1981, the quote on existing 30-year bonds plunged dramatically, sending long-term rates to their highest levels in history. Government then adopted much more stringent anti-inflationary policies and the bonds entered a bull trend that has lasted for one-quart

er century, with bond quotes rising inside a well-defined channel (dashed lines). As bond quotes have risen, interest rates have fallen, culminating in the blow-off of December 2008, when bonds reached nearly 143 (H), while long-term rates plunged to under three percent, driven downward by deliberate Federal Reserve actions.

er century, with bond quotes rising inside a well-defined channel (dashed lines). As bond quotes have risen, interest rates have fallen, culminating in the blow-off of December 2008, when bonds reached nearly 143 (H), while long-term rates plunged to under three percent, driven downward by deliberate Federal Reserve actions.During the past two years, bonds have formed a tight “head and shoulders top” with the left shoulder (LS) near 123, a head close to 143 and a right shoulder (RS) at about 125. A well-defined “neckline” (dotted line) shows support at about 113.

Should bonds break below that neckline, one measuring technique states that the fall from the neckline would equal the distance from the head (H) at 143 to the neckline near 113—or about 30 points. If this occurs, bonds would drop to about 83, far below the bottom of the channel, which has held for 25 years or more, thereby indicating a reversal of the entire bullish trend.

Given the importance of interest rates to the cost of mortgages, car financing and government debt, the trend in bonds is of vital importance and it will be most interesting to follow these moves in the coming year.

_______________

Our “World of Gold” indicators are as follows:

(Note: A “Positive” rating means the situation is beneficial for precious metal prices.)

INFLATION—Remains NEGATIVE. Raw material prices for petroleum as well as base and precious metals continue to strengthen, but to date there has been little visible price inflation of a nature that would concern the general public.

INTEREST RATES—Changes to NEUTRAL. As noted in our Chart Analysis, the trend for long-term interest rates appears to be changing, with those rates now approaching 5 percent. Short-term rates remain fixed at near zero.

INTERNATIONAL TEMPERATURE—Remains POSITIVE. The threat of international terrorism became distressingly clear to millions of air passengers caught up in the aftermath of the attempted bombing of a Northwest Airlines flight in late December. Resentment over the impact of such episodes on day-to-day life is growing, perhaps leading to an escalation of such confrontations.

US DOLLAR—Remains POSITIVE. Despite a modest rally over the past few weeks, the US Dollar continues to trade near its lowest levels in several years and the trend toward huge increases in government debt and deficits continues unabated (see two-year DXY chart).

US ECONOMIC TEMPERATURE—Changes to POSITIVE. As the economy begins to show signs of re-strengthening, pressures on the debt market are likely to grow, thereby increasing the potential for an inflation-driven increase in interest rates, which would threaten to abort any nascent recovery.

US POLITICAL CONFIDENCE —Remains POSITIVE. President Obama’s approval ratings, now at around 47%, are some of the lowest ever received by a first-year president. In addition, the public’s confidence in Congress in particular and politicians in general to satisfactorily resolve society’s problems continues to plummet.

WORLD’S STOCK MARKETS —Remains NEUTRAL. While most markets have recovered somewhat, they remain about halfway between their highs of 2007-2008 and their lows of early 2009. As examples, Germany’s DAX is now trading near 6,000, halfway between the high of about 8,000 and their low of about 4,000. For France’s CAC, the relevant numbers are 6,100, 2,600 and 4,000.

GOLD’S TECHNICAL POSITION—Remains POSITIVE. Gold’s short-term trend has improved to neutral while both the intermediate and long-term trends remain solidly bullish. Important points to watch for are $1,250, representing a clear new breakout to the upside and a violation of strong support in the $800-850 zone, which would have strongly negative implications.

Total Score: Positive, 5; Neutral, 2; Negative, 1.

_______________

Final Thoughts...

Sometimes, the sheer volume of news focuses our attention toward matters of political and financial philosophies and therefore, it is possible we have neglected taking a good look at current fundamentals of supply and demand as they relate to both precious and base metals. We plan to focus on that area next month.

In the meantime, we cannot help but wonder if some sort of public momentum toward diminishing the scope of government interventions is beginning to grow. We will also take a look in that direction next month as well, particularly as such considerations relate to our world of metals and mining.

Until then, happy prospecting!

© ICMJ's Prospecting and Mining Journal, CMJ Inc.

Next Article »« Previous Article

Additional articles that might interest you...

Company Notes

January 2005

• Newmont Mining Corp.

• Frontier Pacific Mining Corp.

• Sterling Mining Company

• General Atomics

• Barrick Gold Corp.

• New Jersey Mining Company

• Timberline Resources Corp.

• Newmont Mining Corp.

• Frontier Pacific Mining Corp.

• Sterling Mining Company

• General Atomics

• Barrick Gold Corp.

• New Jersey Mining Company

• Timberline Resources Corp.

Legislative and Regulatory Update

August 2012

• National Strategic and Critical Minerals Production Act

• CA suction dredging update

• Appropriations Bill addresses problems at EPA

• Bad science, worse policy

• National Strategic and Critical Minerals Production Act

• CA suction dredging update

• Appropriations Bill addresses problems at EPA

• Bad science, worse policy

Miners Discuss Struggles at NWMA

January 2009

Falling metal prices and rising production costs have squeezed profits in recent months, forcing many mine layoffs and putting some new mines on hold. Now, the industry is gearing up for another fight over mining reform legislation with a Congress that has fewer mining supporters after November’s elections that saw Democratic majorities increase in both houses.

Falling metal prices and rising production costs have squeezed profits in recent months, forcing many mine layoffs and putting some new mines on hold. Now, the industry is gearing up for another fight over mining reform legislation with a Congress that has fewer mining supporters after November’s elections that saw Democratic majorities increase in both houses.

Wyoming's Billion Dollar Nugget—The Trilogy Ends

June 2011

The next hurdle to jump was whether the trommel motor would start again after sitting on the desert for six years without being started. The last time it had taken a three foot pipe wrench to bust it loose.

The next hurdle to jump was whether the trommel motor would start again after sitting on the desert for six years without being started. The last time it had taken a three foot pipe wrench to bust it loose.

The next hurdle to jump was whether the trommel motor would start again after sitting on the desert for six years without being started. The last time it had taken a three foot pipe wrench to bust it loose.

The next hurdle to jump was whether the trommel motor would start again after sitting on the desert for six years without being started. The last time it had taken a three foot pipe wrench to bust it loose.

Ask The Experts - Can you explain how caliche forms?

February 2020

Ask the Experts—How can I separate gold from carbon?

April 2007

Q: [I have] fine gold in activated coconut shell carbon after treatment with a battery charger, battery and salt, from my deep wells. In the furnace, the carbon does not burn away to free the gold, but mixes worse than ever...

Q: [I have] fine gold in activated coconut shell carbon after treatment with a battery charger, battery and salt, from my deep wells. In the furnace, the carbon does not burn away to free the gold, but mixes worse than ever...

Subscription Required:

The Bawl Mill

• Legislative and Regulatory Update

• Mining Reform and Congress

• Placer Mining in Canada's Yukon Territory

• California's Rich Pocket Mines

• The Significance of Boulders in Placer Deposits

• Oregon Suction Gold Dredgers Score Big Win

• Michigan Approves Nickel, Copper Mine

• Desert Drywashing

• The History of Gold Mining in Sierra County

• Mining Stock Quotes & Mineral and Metal Prices

Free: