Large Scale Mining

El Tigre—Unlocking Values in Tailings to Jumpstart a Mine

May 2012 by Leonard Melman

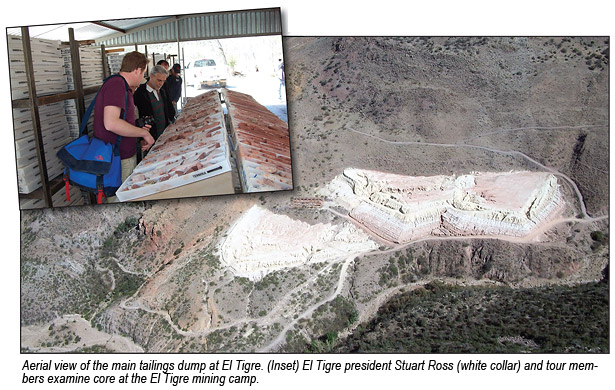

There are many approaches to building value in a junior mining company. These might include establishing profitable production to finance exploration of another portion of a project, extensive exploration to build in-situ values or other well known methods. However, one Vancouver-based Canadian junior, El Tigre Silver Corp, is taking a somewhat different path toward developing their El Tigre property located in the northern Mexican state of Sonora.I was able to visit the El Tigre property in early April 2012, accompanied by El Tigre’s President Stuart Ross, Country Manager Jose Velasquez and Corporate Communications Manager Rob Grace as well as a brokerage house financial analyst. The project is comprised of eight mining concessions that are 100%-owned by the

company and cover 431 square kilometers located within the general area known as the Sierra Madre gold/silver belt. El Tigre’s base camp is at an altitude of approximately 6,500 feet above sea level.

company and cover 431 square kilometers located within the general area known as the Sierra Madre gold/silver belt. El Tigre’s base camp is at an altitude of approximately 6,500 feet above sea level.The property’s most unique feature and one that is an integral part of the company’s overall strategy is a sizeable body of tailings estimated to be in the range of .75 to 1.0 million metric tonnes. These tailings, and others at the project, are directly related to the very extensive mining history at what became known as the El Tigre Mine.

An American prospector, James Taylor, made the initial discovery in an area of the property known as “Gold Hill” in 1896. Taylor then formed the Lucky Tiger Combination Gold Mining Company and mining operations started in 1903 under that company’s subsidiary known as “El Tigre Mining Company.” Production initially focused on gold, but it soon became clear that the greatest revenue could be obtained from silver due to the high grades at the property.

Active mining operations at El Tigre began in 1903 and continued through 1938, despite difficulties such as the Mexican Revolution from 1910 to 1920, the murder of the mine superintendent in 1918, and a gradual decline in the quality of reserves combined with low silver prices in the late 1930s. By the time production ceased in 1938, the El Tigre Mine had eventually produced an estimated 70,000,000 to 75,000,000 ounces of silver from multiple veins located over a 5.3 km exploration length. According to historic records, ore processed at the mine averaged 40 ounces of silver per short ton along with other credits for gold, copper, zinc and lead.

Production reached its peak level of activity from 1921 to 1928, and during that era there were as many as 3,000 people living in the vicinity of the mining camp that provided housing, a school and even a primitive jail facility built into a hillside. Most of the mining equipment was ultimately removed and recycled to other mines.

The mine went through a quiet period from 1939 to 1981 until Anaconda obtained an exploration option in October 1981 and conducted exploration work until early 1984. During this period they drilled 21 core holes covering 7,813 meters and also drove a 352-meter tunnel into the Fundadtora Vein in the North Vein area of the project.

Anaconda failed in its efforts to find new high grade deposits and El Tigre geologists believe this was due to the fact that Anaconda’s drilling took place below productive areas. However, of particular note is the report produced by Anaconda (non-NI 43-101 qualified) that the major tailings body contained 1,400,000 tons and graded an average of 83 grams per ton (gpt) silver (Ag) as well as 0.23 gpt gold (Au).

The major tailings body includes two giant tailings ponds, and there are also the remains of a structure that is now obsolete, but was originally intended as part of a recovery program from the tailings in the 1970s by two previous owners.

Another quiet period ensued between 1985 and 2008, when the El Tigre era began. Minera Talaiman had taken control of the project from Anaconda in 1985 and they were acquired by Pacemaker Silver which, in turn, was taken over by Herndon Capital. Herndon then became “El Tigre Silver” in early 2010 through a qualifying transaction and El Tigre initiated exploration work that year including rehabilitating existing structures and erecting a core shack, drilling ten core holes, establishing new drilling targets, taking samples and also hiring new technical staff.

During 2011, El Tigre conducted a 46-hole auger drilling program at the tailings that was completed in November 2011, which returned assay values ranging from 43 to 172 gpt Ag and averaged 88.1 gpt or 2.6 ounces per ton (opt). This compared favorably with channel samples that returned values ranging from 54 to 157 gpt Ag and averaged 87.7 gpt Ag. Gold values averaged 0.32 gpt Au in the auger samples and 0.315 gpt Au in the channel samples.

Company geologists are now conducting studies to determine optimum recovery methods for the major tailings body including an array of metallurgical reviews.

One of the distinct advantages of processing tailings to recover contained metals is the fact that the rock is already broken and may require only one final crushing. In El Tigre’s case, the crusher would be built near the major tailings body itself to minimize transportation costs. Other infill ores would then be crushed and mixed in with ore from the major tailings body before processing at a Merrill-Crowe recovery facility.

There are two primary sources of these other ores. First, there is an additional smaller stockpile of mine rock estimated to contain anywhere from zero to fifteen ounces of silver per ton or an average of about 7-8 opt Ag and El Tigre plans to use that body of mine rock to combine it with tailings from the major stockpile in a ratio of about 1/4 to 3/4 as a “kicker” for the overall grade to be processed.

The other source of possible ore is from waste material that was used as backfill during the original mining operations. It is believed that such material may contain ore of potential value but neither the quantity nor quality of that source has been determined to date.

Based on past records and their own studies, numerous veins have been identified at the property. Those veins that were worked during the productive period include El Tigre, Seitz-Kelly, Sooy, Combination and Protectora—listed in order of importance to past production. Other veins include Aguila, Escondida, Fundadtora

and the low grade Gold Hill Zone. It is this last area that is a primary focus of El Tigre’s present exploration work, but the company believes the Seitz-Kelly vein also possesses excellent potential for high-grade discoveries.

and the low grade Gold Hill Zone. It is this last area that is a primary focus of El Tigre’s present exploration work, but the company believes the Seitz-Kelly vein also possesses excellent potential for high-grade discoveries.El Tigre’s 2012 drill program for Gold Hill is already underway with one drill rig in operation 24 hours per day, seven days per week. The program consists of 24 holes drilled to an average depth of 100-300 meters and covering approximately 5,000 meters in total over a target area of about 1.4 kilometers. Company geologists have determined that Gold Hill holds a well-developed, low grade gold stockwork zone in the hanging wall rocks of the once-highly productive El Tigre silver-gold vein.

It is worth noting that the Gold Hill area now being explored is in the same zone as the original gold ore discovery in 1896, which led to the initial opening of the El Tigre Mine.

Permitting for the tailings processing has already been submitted and the company anticipates approval within the next month or two. Assuming a positive permitting outcome, it would then take approximately six months to construct production facilities leading to the company’s goal of entering active production before the end of 2012.

El Tigre’s plans for processing the ore include the construction of a vat leaching process and then transference of material recovered through that process to a Merrill-Crowe processing facility with the ultimate goal being the recovery of gold/silver doré bars. Country Manager Jose Velasquez recently visited the Dia Bras Malpaso mill located in Chihuahua State to study their leaching methods, which allowed for an increase in recoveries from a range of 50-60% up to about 90%. El Tigre’s proposed recovery system will be similar in concept to that in operation at Malpaso.

Processing facilities will be built on a flat, level area near the major tailings body. The present plan is to initially haul the tailings to the production facilities by truck and then, eventually, to build a conveyor system to move them on a continual basis once sufficient revenue is developed. The estimated cost for the plant is about $4.5 million and the company is planning to take on debt for that amount. Estimated processing life of the tailings is about five years.

The estimated total cost to implement the recovery plan is about $5 million and the company is planning to take on debt for that amount.

El Tigre’s current overall working plan going forward includes placing the tailings into production as early as possible; exploring and developing a low-grade, open-pitable deposit at Gold Hill; and exploring and developing high-grade, underground silver-gold deposits. Vein targets for future exploration include Sooy, Seitz-Kelly and Combination. The company also plans a 10,000-meter drilling program beginning in about one year specifically designed to explore for high-grade silver mineralization.

Access to the project area is by road from Hermosillo, a journey of some five hours, or by fixed wing aircraft from either Hermosillo or Chihuahua City to landing strips in the general region and then a short helicopter ride to the base camp. Infrastructure in the area provides for adequate water, power and an abundant source of workers from area towns and villages.

_______________

Further information is available on the Internet at www.eltigresilvercorp.com or via email at rgrace@eltigresilvercorp.com

The Basics of Exploration Leases and Contracts—Part II

This is the point where you might ask, “What do these types of contracts typically look like and how are they negotiated?” Well, that is the topic of this month’s article.

This is the point where you might ask, “What do these types of contracts typically look like and how are they negotiated?” Well, that is the topic of this month’s article.

USFS OKs Exploratory Drilling in Eastern Idaho

The new plan approved by the FS says water for drilling at Dog Bone Ridge will now come from Beaver Creek rather than Coral Creek. The agency also said Excellon has added several monitoring sites associated with Dog Bone Ridge.

The Basics of Crushing and Milling Operations

In processing gold, silver and other valuable ores, the minerals containing the values, such as metallic gold, silver-bearing sulfides or other minerals, must be freed from the surrounding host rock before those valuable minerals can be captured.

In processing gold, silver and other valuable ores, the minerals containing the values, such as metallic gold, silver-bearing sulfides or other minerals, must be freed from the surrounding host rock before those valuable minerals can be captured.

Claim Staking Rush Northern Quebec, Canada

...at least 10 junior mining companies have been busy pounding stakes in the ground of northern Quebec in hopes of claiming rich nickel deposits.

The Bawl Mill

• Just because it looks American, doesn’t mean it is…

• Attempted hacking by Homeland Security?

• 37% more than they counted on…

• The high price of wind power

Subscription Required:

The Bawl Mill

• Ask the Experts: gold per ton; improving assay method

• Bering Sea Gold—Part II

• Tucson Show Marketing

• Ganes Creek Hits 10 Years—Part I

• Fabulous Florence—The Golden Town of Idaho

• Arizona's Vulture Gold Mine and Lost Dutchman

• Critical Metals: Copper

• Replacing Your 12-Volt Pump

• Melman on Gold & Silver

• Mining Stock Quotes and Mineral & Metal Prices

Free:

Legislative and Regulatory Update

• Ask the Experts: Ionizing mercury