All Articles

Metals Trader Blows the Whistle on Gold & Silver Price Manipulation

May 2010 by Scott Harn

In November of 2009, London precious metals trader Andrew Maguire contacted the US Commodities Futures Trading Commission (CFTC) with inside information on futures traders working for JP Morgan/Chase. JP Morgan/Chase had taken on a huge short position in silver when they bought the remnants of failed firm Bear Stearns in March 2008.According to Maguire, he learned the signals JP Morgan/Chase gives their metals traders to indicate it is time to short silver to artificially drop the price of the metal, and he provided this information to the CFTC. Maguire subsequently was interviewed for an hour by a CFTC investigator.

In February 2010, Maguire contacted Bart Chilton and Eliud Ramirez of the CFTC again by email, giving specific details of silver price manipulation two days before it would occur and JP Morgan/Chase’s plan to profit on it based upon the signals he had learned. JP Morgan/Chase was about to use their overwhelming position in silver to manipulate the price.

The story played out just as Maguire had detailed. He followed up with additional emails to the CFTC, providing even more evidence of the manipulation that had occurred.

Eventually the CFTC held a hearing on possible manipulation, but Maguire was left out of the process. He sought out Adrian Douglas, director of the Gold Anti-Trust Action committee, otherwise known as GATA. GATA has been trying for many years to prove the precious metals markets are being manipulated by several large banking firms.

Maguire provided GATA with the same information he had given the CFTC, and GATA released the information to the press.

The story gets much more intriguing from here. The very next day, Maguire was leaving a grocery store with his wife when a vehicle sped out of a side alley and struck Maguire’s vehicle broadside. Bystanders blocked the other driver from leaving the scene until the suspect accelerated toward them and forced them to flee. The suspect struck several other parked vehicles while trying to escape. The driver was eventually caught by police, who were assisted by fellow officers in a helicopter. Both Maguire and his wife were treated and released from a local hospital. As of press time, the identity of the suspect has not been released.

Maguire gave a detailed interview to King World News, an Internet-based radio station, on March 29.

Maguire stated that in 2008 the price of silver crashed from over $20 per troy ounce to less than $9 per troy ounce in a matter of a few weeks after JP Morgan/Chase acquired the short silver positions in the takeover of Bear Stearns. He said that while manipulation is occurring in both the gold and silver markets, it is much easier to spot in the silver market because of its much smaller size, and this “take down” of the silver price was clearly manipulation.

Maguire and the traders and companies they represent were all aware of the price manipulation and were all profiting from it, but it became such a regular occurrence that his conscience told him it was time to put a stop to it. That’s when he contacted the CFTC.

Maguire said he was “amazed” that CFTC investigators did not seem to know what to look for, so he took it upon himself to educate them. In his February 3 email to Chilton and Ramirez, he detailed the “take down” in the silver price that would occur on February 5. He included details on the timing, method and magnitude of the transactions that would happen just two days later based on the signals he received from JP Morgan/Chase. He monitored the trades, which included overwhelming short positions taken by JP Morgan/Chase. On his computer, he saved copies or “screen shots” of the action and provided them to the CFTC so they could see the market manipulation for themselves. As he explained in his earlier email, the silver price would be allowed to “spike” upward, then would be taken down drastically. He provided CFTC with a running commentary, describing what would happen at each stage of the trading day before it happened based on prior experience with market manipulation by JP Morgan/Chase. He also detailed how the price would be pushed below $15 per troy ounce, and showed them how the price was pushed back down by rapid sales each time it tried to break through the $15 mark. The price was held at or below that mark until the manipulator decided it was time to let it go. The traders who were part of a tight-knit group would then buy into the market and the price was allowed to rise.

Maguire summarized the trading day in an email to CFTC regulators at the end of the day (see email). The CFTC followed up with a meeting to collect testimony on possible market manipulation, but Maguire was not invited. “That is when I got so, so angry…” said Maguire, so he contacted Adrian Douglas at GATA and the information was made public.

Maguire stated he is motivated by the need to “level the playing field.” He added, “Large parties … who are in absolute full control, can run the market up and down at will. I want it cleaned up, and I want it legal and honest.”

GATA director Adrian Douglas said that $5.4 trillion per year is traded through the London Bullion Market Association, and believes this will become the biggest fraud in financial history.

During the CFTC meeting, which occurred without Maguire, some remarkable testimony was given by Jeffrey Christian of metals trader CPM Group. Christian backed the position of the large bullion banks, claiming that this type of trading is commonplace and acceptable. His most revealing remark involved the non-existence of the gold and silver being traded. He claimed that each ounce of gold had 100 separate paper claims on it. That means that if only 1 out of every 100 buyers wanted physical delivery of the gold or silver they purchased, then everything would be fine. But if more customers wanted to take physical possession, they would receive cash instead—there is not enough gold or silver to meet obligations.

“People say, and you heard it today, there is not that much physical metal out there, and there isn’t,” said Christian.

Andrew Maguire blew the whistle on this fraud and should be commended.

Jeffrey Christian confirmed that gold and silver markets, for all intents and purposes, are just Ponzi schemes. Those who run the large bullion banks and trading firms that have been selling gold and silver and charging storage fees for metals they don’t have should be treated no differently than Bernie Madoff. It’s time to lock them up.

You can tell the CFTC that it’s time for them to do their job, prosecute those responsible for manipulation of gold and silver prices, and allow these commodities to seek their proper market price.

To contact the CFTC:

By email: oig@cftc.gov

By phone: 202 418-5510

By mail:

CFTC

Office of the Inspector General

Three Lafayette Centre

1155 21st St NW

Washington, DC 20581

Below you will find all the emails between Andrew Maguire and the CFTC, followed by links to Maguire's interview with King World News and other sources.

From: Andrew Maguire

Sent: Tuesday, January 26, 2010 12:51 PM

To: Ramirez, Eliud [CFTC]

Cc: Chilton, Bart [CFTC]

Subject: Silver today

Dear Mr. Ramirez:

I thought you might be interested in looking into the silver trading today. It was a good example of how a single seller, when they hold such a concentrated position in the very small silver market, can instigate a selloff at will.

These events trade to a regular pattern and we see orchestrated selling occur 100% of the time at options expiry, contract rollover, non-farm payrolls (no matter if the news is bullish or bearish), and in a lesser way at the daily silver fix. I have attached a small presentation to illustrate some of these events. I have included gold, as the same traders to a lesser extent hold a controlling position there too.

Please ignore the last few slides as they were part of a training session I was holding for new traders.

I brought to your attention during our meeting how we traders look for the "signals" they (JPMorgan) send just prior to a big move. I saw the first signals early in Asia in thin volume. As traders we profited from this information but that is not the point as I do not like to operate in a rigged market and what is in reality a crime in progress.

As an example, if you look at the trades just before the pit open today you will see around 1,500 contracts sell all at once where the bids were tiny by comparison in the fives and tens. This has the immediate effect of gaining $2,500 per contract on the short positions against the long holders, who lost that in moments and likely were stopped out. Perhaps look for yourselves into who was behind the trades at that time and note that within that 10-minute period 2,800 contracts hit all the bids to overcome them. This is hardly how a normal trader gets the best price when selling a commodity. Note silver instigated a rapid move lower in both precious metals.

This kind of trading can occur only when a market is being controlled by a single trading entity.

I have a lot of captured data illustrating just about every price takedown since JPMorgan took over the Bear Stearns short silver position.

I am sure you are in a better position to look into the exact details.

It is my wish just to bring more information to your attention to assist you in putting a stop to this criminal activity.

Kind regards,

Andrew Maguire

* * *

From: Ramirez, Eliud [CFTC]

To: Andrew Maguire

Sent: Wednesday, January 27, 2010 4:04 PM

Subject: RE: Silver today

Mr. Maguire,

Thank you for this communication, and for taking the time to furnish the slides.

* * *

From: Andrew Maguire

To: Ramirez, Eliud [CFTC]

Cc: BChilton [CFTC]

Sent: Wednesday, February 03, 2010 3:18 PM

Subject: Re: Silver today

Dear Mr. Ramirez,

Thanks for your response.

Thought it may be helpful to your investigation if I gave you the heads up for a manipulative event signaled for Friday, 5th Feb. The non-farm payrolls number will be announced at 8.30 ET. There will be one of two scenarios occurring, and both will result in silver (and gold) being taken down with a wave of short selling designed to take out obvious support levels and trip stops below. While I will no doubt be able to profit from this upcoming trade, it is an example of just how easy it is to manipulate a market if a concentrated position is allowed by a very small group of traders.

I sent you a slide of a couple of past examples of just how this will play out.

Scenario 1. The news is bad (employment is worse). This will have a bullish effect on gold and silver as the U.S. dollar weakens and the precious metals draw bids, spiking them higher. This will be sold into within a very short time (1-5 mins) with thousands of new short contracts being added, overcoming any new bids and spiking the precious metals down hard, targeting key technical support levels.

Scenario 2. The news is good (employment is better than expected). This will result in a massive short position being instigated almost immediately with no move up. This will not initially be liquidation of long positions but will result in stops being triggered, again targeting key support levels.

Both scenarios will spell an attempt by the two main short holders to illegally drive the market down and reap very large profits. Locals such as myself will be "invited" on board, which will further add downward pressure.

The question I would expect you might ask is: Who is behind the sudden selling and is it the entity/entities holding a concentrated position? How is it possible for me to know what will occur days before it will happen?

Only if a market is manipulated could this possibly occur.

I would ask you watch the "market depth" live as this event occurs and tag who instigates the move. This would surly help you to pose questions to the parties involved.

This kind of "not-for-profit selling" will end badly and risks the integrity of the COMEX and OTC markets.

I am aware that physical buyers in large size are awaiting this event to scoop up as much "discounted" gold and silver as possible. These are sophisticated entities, mainly foreign, who know how to play the short sellers and turn this paper gold into real delivered physical.

Given that the OTC market (where a lot of the selling occurs) runs on a fractional reserve basis and is not backed up by 1-1 physical gold, this leveraged short selling, where ownership of each ounce of gold has multi claims, poses a very large risk.

I leave this with you, but if you need anything from me that might help you in your investigation I would be pleased to help.

Kind regards,

Andrew T. Maguire

* * *

From: Andrew Maguire

To: Ramirez, Eliud [CFTC]

Sent: Friday, February 05, 2010 2:11 PM

Subject: Fw: Silver today

If you get this in a timely manner, with silver at 15.330 post data, I would suggest you look at who is adding short contracts in the silver contract while gold still rises after NFP data. It is undoubtedly the concentrated short who has "walked silver down" since Wednesday, putting large blocks in the way of bids. This is clear manipulation as the long holders who have been liquidated are matched by new short selling as open interest is rising during the decline.

There should be no reason for this to be occurring other than controlling silver's rise. There is an intent to drive silver through the 15 level stops before buying them back after flushing out the long holders.

Regards,

Andrew

* * *

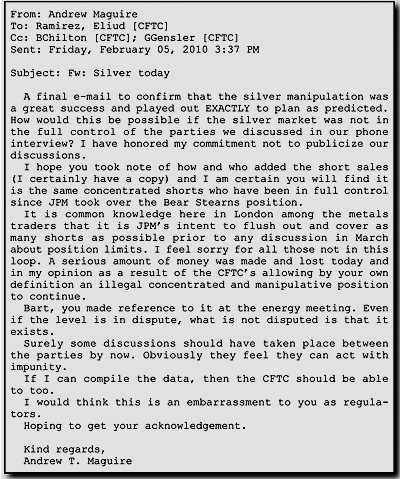

From: Andrew Maguire

To: Ramirez, Eliud [CFTC]

Cc: BChilton [CFTC]; GGensler [CFTC]

Sent: Friday, February 05, 2010 3:37 PM

Subject: Fw: Silver today

A final e-mail to confirm that the silver manipulation was a great success and played out EXACTLY to plan as predicted yesterday. How would this be possible if the silver market was not in the full control of the parties we discussed in our phone interview? I have honored my commitment not to publicize our discussions.

I hope you took note of how and who added the short sales (I certainly have a copy) and I am certain you will find it is the same concentrated shorts who have been in full control since JPM took over the Bear Stearns position.

It is common knowledge here in London among the metals traders that it is JPM's intent to flush out and cover as many shorts as possible prior to any discussion in March about position limits. I feel sorry for all those not in this loop. A serious amount of money was made and lost today and in my opinion as a result of the CFTC's allowing by your own definition an illegal concentrated and manipulative position to continue.

Bart, you made reference to it at the energy meeting. Even if the level is in dispute, what is not disputed is that it exists. Surely some discussions should have taken place between the parties by now. Obviously they feel they can act with impunity.

If I can compile the data, then the CFTC should be able to too.

I would think this is an embarrassment to you as regulators.

Hoping to get your acknowledgement.

Kind regards,

Andrew T. Maguire

* * *

From: Andrew Maguire

To: Ramirez, Eliud [CFTC]

Sent: Friday, February 05, 2010 7:47 PM

Subject: Fw: Silver today

Just logging off here in London. Final note.

Now that gold is undergoing short covering, please look at market depth right now in silver and evidence the large selling blocks in a thin market being put in the way of silver regaining the technical 15 level, which would cause a short covering rally and new longs being instigated. This is resulting in the gold-silver ratio being stretched to ridiculous levels.

I hope this day has given you an example of how silver is "managed" and gives you something more to work with.

If this was long manipulation in, say, the energy market, the shoe would be on the other foot, I suspect.

Have a good weekend.

Andrew

* * *

From: Andrew Maguire

Sent: Tuesday, February 09, 2010 8:24 AM

To: Ramirez, Eliud [CFTC]

Cc: Gensler, Gary; Chilton, Bart [CFTC]

Subject: Fw: Silver today

Dear Mr. Ramirez,

I hadn't received any acknowledgement from you regarding the series of e-mails sent by me last week warning you of the planned market manipulation that would occur in silver and gold a full two days prior to the non-farm payrolls data release.

My objective was to give you something in advance to watch, log, and follow up in your market manipulation investigation.

You will note that the huge footprints left by the two concentrated large shorts were obvious and easily identifiable. You have the data.

The signals I identified ahead of the intended short selling event were clear.

The "live" action I sent you 41 minutes after the trigger event predicting the next imminent move also played out within minutes and exactly as I outlined.

Surely you must at least be somewhat mystified that a market move could be forecast with such accuracy if it was free trading.

All you have to do is identify the large seller and if it is the concentrated short shown in the bank participation report, bring them to task for market manipulation.

I have honored my commitment to assist you and keep any information we discuss private,however if you are going to ignore my information I will deem that commitment to have expired.

All I ask is that you acknowledge receipt of my information. The rest I leave in your good hands.

Respectfully yours,

Andrew T. Maguire

* * *

From: Ramirez, Eliud

To: Andrew Maguire

Sent: Tuesday, February 09, 2010 1:29 PM

Subject: RE: Silver today

Good afternoon, Mr. Maguire,

I have received and reviewed your email communications. Thank you so very much for your observations.

Audio Interview

Andrew Maguire and Adrian Douglas (GATA) are interviewed by King World News. (Note: It's an audio interview, and is very slow to load!)

New York Post article

Video of GATA president Bill Murphy offering testimony regarding the manipulation to the CFTC. Unfortunately he was given a minimal amount of time to enter his comments, so he had to rush through the testimony.

PLP and MMAC Update

We have an opportunity to make significant and substantial changes to provide relief for small miners with the Trump Administration and the current makeup of Congress. We realize the time to act is now, but we need your help.

We have an opportunity to make significant and substantial changes to provide relief for small miners with the Trump Administration and the current makeup of Congress. We realize the time to act is now, but we need your help.

Melman on Gold & Silver

…Washington and America have never seen a flow of actions by a new President to match what Trump has done during his first three weeks, but those actions suggest two interpretations.

Our Readers Say

I enjoy your magazine very much. I read it from cover to cover every month.

Economic Analysis on Critical Habitat for Bull Trout

The US Fish & Wildlife Service has released the economic analysis and reopened the comment period for their proposal to designate critical habitat for the bull trout in 18,469 river miles and 532,721 acres of lake and reservoir habitat across the Western states.

Melman on Gold & Silver

Perhaps the heart of our pro-gold thesis is this consideration: governments are inherently inefficient, they attempt to provide services far beyond their genuine fiscal ability and these trends result in deficit financing, growing debt levels and ultimate “watering” down of currency values.

SilverCrest Mines Inc.

During the past decade, silver has been in a pronounced bull market, which many analysts attribute to its unique attractions as both a monetary and industrial metal. One Canadian junior miner, SilverCrest Mines Inc., is working actively to take advantage of silver’s favorable performance by steadily expanding production at its flagship Santa Elena Mine...

"No Gold Sales" Says Nevada Senator

Senator Richard Bryan (D-NV) is assuring gold producers in Nevada and around the world that Congress will block the Clinton administration's attempt to sell off international gold reserves to help some debt-laden poor countries.

Subscription Required:

The Bawl Mill

• Legislative and Regulatory Update

• Ask The Experts: How to handle gold in cyanide; how to sample a platinum deposit

• Prospecting for Hardrock Gold - "Eureka!" (Part III)

• Gold Prospecting in Maine - Part II

• American Manganese

• Detecting for Gold in Australia

• Investors Take a Shine to Platinum, Palladium

• Melman on Gold & Silver

• Mining Stock Quotes & Mineral and Metal Prices

Free:

Oregon Requires Permit for Hand Sluicing

• California Water Board Tries to Restrict Dredging