All Articles

Melman on Gold & Silver

July 2009 by Leonard Melman

It is becoming increasingly clear that Barack Obama will be an activist President. Unlike his predecessors, he appears set on using the powers of government in an unusually aggressive manner in order to accomplish “public good.”

One facet of that activism is the power of the President to nominate members of the United States Supreme Court, and Obama made his first such choice last month in the person of Sonia Sotomayor. If approved, she would become the first Hispanic Justice and only the third woman named to the court.

Obama also made news of an intriguing nature when he made a major address in Egypt directed toward the international Islamic community. Two features of his speech made headlines. First, he directed Israel to stop building settlements in lands occupied by previous Palestinian populations; and second, he refused to pledge the use of military force against Iran, should that nation achieve nuclear weapons status. Obviously, much debate is ongoing regarding the implications of the speech, which was listened to by well over 100 million people.

Another major source of headlines during the past month was the progress of bankruptcies involving both General Motors and Chrysler, and the concurrent announcements from both companies that a multitude of auto dealerships would be losing their franchises. The bankruptcies inflicted huge losses on bondholders, particularly in regard to GM (see below).

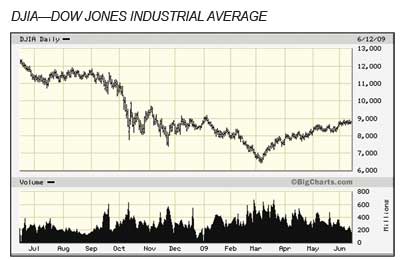

Financial markets continued to reflect some growing level of optimism that the worst of the economic debacle is now behind us. However, I note that the advance seems difficult and labored, as evidenced by the daily chart of the Dow Industrials. Also, just as last month, long-term bond markets continued to reflect significantly higher interest rates despite all efforts of government to drive them down. These high rates are impacting home financing and long-term, fixed annual rates are now rising sharply in both the USA and Great Britain. As a result, residential real estate numbers are  not advancing as some have anticipated, putting a further damper on hopes for a recovery.

not advancing as some have anticipated, putting a further damper on hopes for a recovery.

Another factor that could put a crimp into any economic recovery is rising petroleum prices. Both Crude Oil and Unleaded Gasoline contract prices rose steadily last month with Crude reaching over $73 per barrel and Unleaded touching $2.06 per gallon. These prices are up from recent lows of $34 and $0.75 respectively late last year.

Economic data continued to reflect difficult times, although some “green shoots” of improvement were coming into view. Among the positive pieces of data is an improvement of 0.7% in New Factory Orders for April, and Business Inventories continued to shrink in the same month. However, negative news continued to abound, particularly on the employment front.

Although the job figures for May were “less bad” (see below) than the previous month, they were still profoundly negative with the loss of an additional 345,000 jobs during May, bringing the total job losses for the recession to over 6 million. In addition, the Unemployment Rate soared to 9.4%, the highest level in more than a quarter-century. Other April data with negative implications showed a 0.2% reduction in Factory Shipments, a steep decline in Housing Starts to the lowest level on record and a further decline in New Building Permits, another indication that a recovery may not be near.

Inflation figures remained quiet for both Consumer and Producer Price indexes.

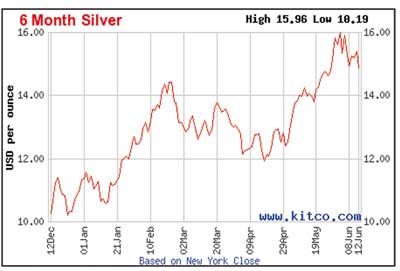

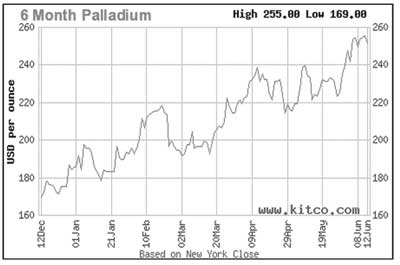

Gold made the news with yet another assault on the $1,000 per ounce level, but has fallen back at press time to near $940, while silver has retreated from about $16.00 to just under $15.00. Several base metals including copper, nickel, zinc and lead all made substantial gains during the month and our mining share lists are dominated by “plus” signs. Despite some setbacks, mining share ind exes continue to improve on balance.

exes continue to improve on balance.

_______________

One of the most intriguing features of the “recovery” that appears to be taking place over the past few months is a transformation in the evaluation of financial and economic news items. There used to be a simple standard that bad news was, indeed, bad news. Nowadays, it seems that the new standard is “less bad equals good.”

Well, the “less-bad-is-good” crowd is having a field day with the release of the May employment figures from the US Department of Labor. Although the economy reported that another 345,000 jobs were lost last month and the Unemployment Rate hit a 25-year high at 9.4%, markets rallied on the fact that the news wasn’t quite as bad as previous months.

While there are growing indications that some economic improvement may indeed take place, there is something much more ominous going on that the “Happy Days Are Here Again” crowd should observe, and that is the degree of stimulation that is taking place this time around—and the meager visible rewards so far—compared to previous post-war periods of economic recession.

America suffered through a bitter recession in 1973-74 and it ran deficits on the order of approximately $50-70 billion—amounting to about 25% of government expenditures—in the next two years to get the economy moving. Following the recession of 1980-82, deficits approached $200 billion—or about 33% of government expenditures. However, this time around, anticipated deficits have soared to the area of $2 trillion—or about 60% of government expenditures—and the economy still appears reluctant to rebound. In other words, the world is getting less bang for the buck from its stimulative measures and, given that it is now taking deficits on the order of ten times what was needed during previous recessionary events, we must raise the question of exactly what might be required in the future if these recently-adopted measures don’t get the job done.

I would also offer two more news items as a source of caution to those who believe the time of serious trouble is safely behind us.

First, a severe banking crisis is brewing in the Baltic State nations, particularly Latvia, which lies directly to the west of Russia along the Baltic Sea. A Wall Street Journal item informs us that, “...The Baltic State is the new front line in the global financial crisis. With an economy in free-fall and unable to finance its deficits—Wednesday’s government bond auction failed—the country needs a substantial devaluation to boost competitiveness and try to fuel a recovery.” Unfortunately, if they devalue their currency, they will likely be unable to repay foreign-currency denominated debt, which will send those loans—mostly owed to European banks—into default and create a new wave of credit contraction.

Swedish banks are in a particularly vulnerable position. Like America, Sweden appears to be ready to inject capital into those institutions, but at the cost of, as the Telegraph newspaper puts it, “...preparing to part-nationalize banks exposed to collapse in Baltic States.”

Second, according to Germany’s central bank, that nation’s economy is going to decline by over 6% this year and, “...stagnate in 2010.” The best they could offer was that, “...economic activity is expected to remain at a subdued level in 2010, despite picking up slightly in the course of the year.”

Looking at this type of information, it is difficult to become enthusiastic about a robust recovery in the near future.

_______________

Chart Analysis—Silver Trust ETF

One of the most popular ways to trade movements in the price of silver is through the Exchange Traded Fund (ETF) called “iShares  Silver Trust.” This ETF, trading under the symbol SLV, mirrors price movements in the underlying metal and serves as an accurate proxy for trading in the metal itself.

Silver Trust.” This ETF, trading under the symbol SLV, mirrors price movements in the underlying metal and serves as an accurate proxy for trading in the metal itself.

During the past two years, SLV has traced out several interesting chart patterns. After rising throughout the last half of 2007 and into 2008, SLV reached a peak just above $20.00 (P1) in March 2008. After falling back to the $16.00 level, SLV formed a “double top” by reaching a second and lower peak at P2, and then fell sharply through support at $16.00 (dashed line).

After reaching a bottom near $8.00 in early fall 2008, the chart formed a true “saucer bottom” (rounded arc), eventually reaching $14.00 before pulling back to the $12.00 level. Silver then turned higher and reached the $16.00 zone in recent sessions.

Silver now trades above a rising trendline (solid line) and is encountering resistance at the previous support zone at $16.00. It is also meeting additional resistance in the form of the downtrend line formed by connecting P1 and P2 (dotted line).

If silver can rise above this declining trendline and also break through resistance between $16.00 and $21.00, then the chart would turn solidly bullish. However, if it does not move higher in the near future, then the descending trendline combined with heavy resistance would become serious technical obstacles to overcome.

_______________

_______________

Perhaps the most unique feature of the ongoing economic downturn hitting America and the rest of the world is its enormous spreading impact as one segment of the economy falters after another. Perhaps this can be best illustrated by concentrating on a single chain of events linking many “players”—in this case the effect of New York real estate on Springfield, Missouri’s municipal budget problems.

I have noted previously on these pages that serious problems are developing within commercial real estate. During the halcyon days of commercial real estate, packages of loans backed by such assets were sold to a multitude of willing purchasers, specifically including pension funds, which were looking for safety of principal combined with generous yields.

One of the companies marketing such assets was Prudential Financial, and perhaps the single largest holding securing their paper was a $1.1 billion skyscraper rising in New York called “11 Times Square.” When the project was first contemplated, rents in that section of New York went for $110 per square foot and no problems filling the building were anticipated.

Springfield Missouri invested in the project via Prudential Financial.

Then one brokerage house after another, one bank after another and one insurance giant after another encountered massive problems and vacancies soared, driving rental prices down to near $69 per square foot.

Consequently, the project no longer “finances out,” and the values of that largest holding of Prudential Financial have plunged, inflicting huge losses on the city of Springfield and its pension plans. As a result, the Wall Street Journal tells us that, “Losses at the police and firefighters’ pension fund have thrown this Ozark city into its worst budget crisis in decades. The city wants to slash spending on health care, parks and roads...”

It’s hard to imagine that troubles at institutions such as Citibank could eventually cause a small child to not have a proper playground in Springfield, Missouri, but that is the world we now live in.

Such stories are an indication of the depth of the problems facing the economic world. The government’s attempt to find “solutions” involves printing vast amounts of federal money and accumulation of massive debt. The potential for rising inflation is growing—and rising inflation historically has been perhaps the most important component of past golden bull markets.

_______________

Few people alive today have ever encountered the ravages of hyperinflation, except those enduring such horrible conditions in modern-day Zimbabwe. Germany is one prominent nation that has suffered through hyperinflation. From November 1922 through the fall of 1923, Germany endured perhaps the most famous of all hyperinflations, when the cost of a postage stamp reached over one billion Marks and price lists of all sorts were revised almost by the hour. Life savings were wiped out, leaving a generation of elderly starving and without assets.

Such events become driven into the memory of a nation and that is the case with Germany. And so, it came as no great surprise that the one European nation fighting against “monetization” and “quantitative easing” is Germany.

In a widely covered speech, German Chancellor Angela Merkel blasted the Fed, the Bank of England and the European Central Bank for engaging in policies that could create a future economic tsunami. Mincing no words, she stated, “We must return together to an independent central-bank policy and to a policy of reason...”

In its comments regarding Merkel’s prepared speech, the WSJ noted, “...German officials traditionally have been on the more conservative end of the central bank’s spectrum, partly because the country’s hyperinflation of the 1920s is seared into people’s memories.”

Of course, any true whiff of even potential hyperinflation would likely impact gold, silver and platinum on the plus side.

_______________

Last month, I noted three story lines that appeared worthy of further comment. These were questions relating to the continuing role of the US Dollar as the reserve currency of the world; developments regarding increasing roles for the government in health care; and the effects of the GM and Chrysler bankruptcies. I offer some short, but hopefully worthwhile observations on each:

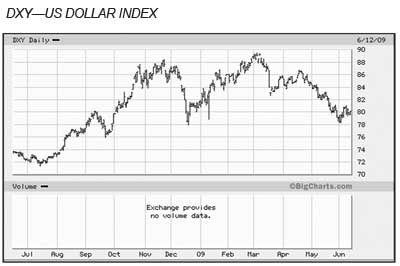

- China seldom “plays games.” When they bring an issue to the public’s attention, they usually have a specific objective in mind, and there is no question that they have been discussing the future of the US Dollar on a regular basis. They are concerned about the falling quotes for US Long-term Treasury Debt—of which they hold many hundreds of billions worth—as well as the recent decline in the US Dollar Index (DXY) (see chart). In addition, without offering any public comments or reasons, they have taken the somewhat unusual steps of building up their physical reserves of gold and base metals. In an attempt to quell their fears, Treasury Secretary Tim Geithner traveled to China to speak to students at Peking University, but the students laughed at him when he reaffirmed his faith in a strong US Dollar. Not a good omen.

- President Obama has stepped up the frequency and decisiveness of statements regarding his commitment to medical insurance coverage for all Americans, and he declared that he wanted such a bill passed before the end of 2009. Among his stated goals is coverage for all, including those who cannot afford monthly payments for such coverage, whether it is issued by government or private enterprise. Unfortunately, two serious problems remain; exactly how to afford such a huge program in the face of ongoing deficits and exactly how government insurance and private insurance, each offering the same product, are going to co-exist.

- GM and Chrysler, as we knew them, are history. GM will emerge from bankruptcy a leaner company and without several historic nameplates including Pontiac, Saturn, Hummer and Saab—all of which are to be either discontinued or sold off. GM bondholders, those persons who provided much of the wherewithal to keep GM in operation through much of the last century, have been offered a paltry 15 cents on the dollar for their holdings. At the opposite end of the spectrum, the government will acquire about 61% ownership in the new company while the United Auto Workers will recover about 60 to 70 cents per dollar on their GM investments. The story is more of the same for Chrysler.

_______________

Our “World of Gold” indicators are as follows:

(Note: A “Positive” rating means the situation is beneficial for precious metal prices.)

INFLATION—Changes to NEUTRAL. Despite the fact that official price indexes remain mired near “unchanged,” strong advances in the prices for the petroleum complex and other raw materials such as base metals (see copper chart) appear to indicate rising future price inflation.

INTEREST RATES—Remains NEUTRAL. Although long-term rates continue to climb to near five percent (see 30-year T-Bond chart), the entire spectrum of short-term rates remains anchored near “zero.”

INTERNATIONAL TEMPERATURE—Remains NEUTRAL. While the world awaits any strong reaction to President Obama’s Egyptian speech, most hot spots around the globe remained relatively quiet last month.

US DOLLAR—Changes to POSITIVE. Not only did the Dollar Index drop sharply during the month, but other serious questions regarding the role of the Dollar as the world’s reserve currency continue to be raised. Combined with immense budgetary deficits and huge increases in America’s national debt, the future of the Greenback is in doubt.

US ECONOMIC TEMPERATURE—Remains POSITIVE. The simple fact remains that the US and other major economies around the world remain mired in contracting economies, which likely will mean continued heavy adoption of expensive “rescue” programs in America and elsewhere.

US POLITICAL CONFIDENCE—Changes to NEGATIVE. Despite some misgivings regarding the size of deficits and some economic data, President Obama appears to be moving from strength to strength in the eyes of the majority of Americans, and his recent Islamic speech has added yet another degree of luster to his political resumé.

WORLD’S STOCK MARKETS —Remains NEUTRAL. Most markets continue to advance slowly, but also remain far below their peaks of last summer. Few made any truly decisive moves last month.

GOLD’S TECHNICAL POSITION—Remains POSITIVE. Despite a late setback from near $1,000 to about $940, gold’s long and intermediate terms remain solidly bullish with continued strong support near and above the $800 per ounce level.

TOTAL SCORE: Positive, 3; Neutral, 4; Negative, 1.

_______________

Final Thoughts:

Two stories caught my eye and appear worthy of some discussion next month, space permitting.

In the first case, Mexico seems to be descending into a period of both social turmoil and economic difficulties. Given that many of the most promising ventures for junior mining companies are located in Mexico, I plan to take a look and see if these continued troubles are likely to have an impact on the exploration and/or operations of these companies.

Also of note, the price of the petroleum complex is on the rise once again. I plan to look at some of the factors behind this rise next month as well.

Until then, happy prospecting and good luck.![]()

Letter to the Editor

In the August 2000 issue of the Journal, the story of the "Quartszite Area" was most informative and accurate.

Watermelon Gold

Awhile back, I was doing some prospecting in a remote mountain region, located in the rugged, well-timbered valleys of north-central British Columbia, an area known for its coarse gold.

Awhile back, I was doing some prospecting in a remote mountain region, located in the rugged, well-timbered valleys of north-central British Columbia, an area known for its coarse gold.

Secrets of Successful Prospecting

Winter is the time for research, and if you haven’t already done some research to find new places to prospect, now is the time to cram in some last minute research before the good weather arrives.

Winter is the time for research, and if you haven’t already done some research to find new places to prospect, now is the time to cram in some last minute research before the good weather arrives.

Detecting For Gold—Are You Up For It?

Over the years that I have been detecting for gold I have had many of the same questions come up. I decided to write this article to hopefully answer some questions that a person wishing to detect for gold may have.

Over the years that I have been detecting for gold I have had many of the same questions come up. I decided to write this article to hopefully answer some questions that a person wishing to detect for gold may have.

Lamproites and Diamonds

Most prospectors are aware that diamonds are sometimes found in kimberlite, but few are aware that diamonds are also found in another rock type known as lamproite. Lamproite is a very rare volcanic rock that often...

Most prospectors are aware that diamonds are sometimes found in kimberlite, but few are aware that diamonds are also found in another rock type known as lamproite. Lamproite is a very rare volcanic rock that often...

Legislative and Regulatory Update

• This is a friendly reminder

• Homebuilders’ case may help miners

• “Ecological resources must be protected…”

Research Tools for The Modern Prospector

Much more information can be gained from that single source and gives you ideas on the gravels for dry washing or where the nuggets may lie for metal detecting

Much more information can be gained from that single source and gives you ideas on the gravels for dry washing or where the nuggets may lie for metal detecting

Subscription Required:

The Bawl Mill

• The Suction Gold Dredging Fight Continues in California

• Gold in the South Pass Greenstone Belt, Wyoming

• Chinese Buy Out Australian Miners

• Using a Winch to Work Smarter, Not Harder

• The Forgotten Specimen—Part II

• Germany Developing Gold Vending Machine

• How to Complete Assessment Work and Claim Maintenance

• More Tennessee Gold

• Mining Stock Quotes and Mineral & Metal Prices