All Articles

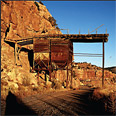

The Paradox Basin—Part I

July 2005 by Bill Rich

In the four corners region of America there is a place—a very special place—called the Paradox Basin. It appears empty, but is quite full if you look at it from the correct perspective.

In the four corners region of America there is a place—a very special place—called the Paradox Basin. It appears empty, but is quite full if you look at it from the correct perspective.

The Bawl Mill

• Does he really “represent” Michigan?

• The California real estate market is hot!

What's All This Talk About Mining Districts?

The main problem with the current scheme is that regulatory agencies often consult with you, then disregard your concerns and do what they want anyway.

Swiss Mining Company Demands Compensation From Bolivia

Glencore International AG demanded compensation from Bolivia’s government for nationalizing a tin smelter owned by the Swiss mining company.

USPS Delays ICMJ Delivery at Oakland, CA Processing Center

Once again, we've been deluged with telephone calls complaining about delivery of the International California Mining Journal...

Junior Miners and Investors Gather in Canada

Two landmark golden gatherings took place in Vancouver, British Columbia near the end of January, and while they both related to the world of gold, they each had a completely different emphasis.

Hard Rock and Placer Gold of Manhattan, Nevada

He found 5 to 7 feet of gravel containing half an ounce per yard. This started a rush of placer activity and several other shafts were sunk, with some large multi-ounce nuggets being found.

He found 5 to 7 feet of gravel containing half an ounce per yard. This started a rush of placer activity and several other shafts were sunk, with some large multi-ounce nuggets being found.

The Bawl Mill

• "Fast and Furious" investigation slowly moving forward

• EPA needs to be held accountable

Subscription Required:

The Bawl Mill

• Our Readers Say

• The Montana Tunnels Discovery

• Spreading the Fever

• Forest Service Final Rule—When is a Notice or Plan Required?

• Looking Back

• New Regulations for Major Precious Metal Dealers

• The Safety in Tax Deductions for Safety

• Understanding and Evaluating Desert Mineralization for Nuggetshooters

• A Search for Tantalum

• Copper is King in Arizona

• Mining Stock Quotes and Mineral & Metal Prices

• Melman on Gold & Silver