Money & Markets

Melman on Gold & Silver

December 2016 by Leonard Melman

On a personal note, very little has bothered me quite as much as the fact that some on the political left are crying “foul” about the fact that Secretary Clinton may have (the outcome is still slightly uncertain at press time) gained more popular votes than the President-elect and therefore the election result is “wrong.”Additional articles that might interest you...

Mining Stock Quotes and Mineral & Metal Prices

December 2016

Resource Maven—Independent Analysis of the Resource Markets

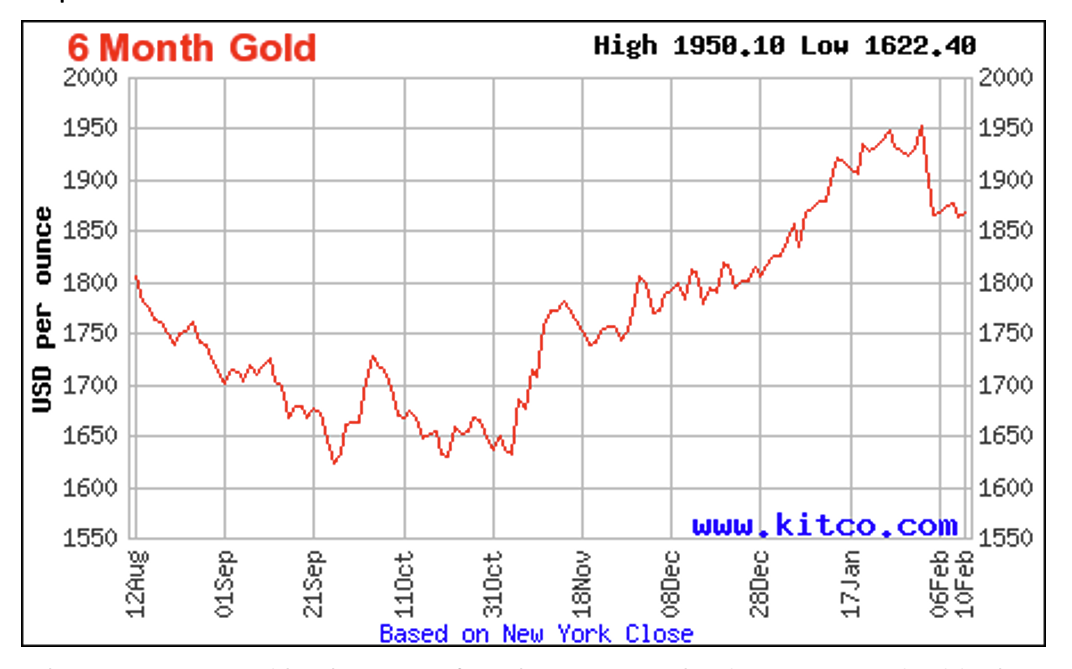

August 2022

There is a great debate raging in the metals comment-sphere: it is time to buy???

Melman on Gold & Silver

February 2016

If precious metals miners and prospectors were looking for a series of dramatic events to usher in the first two weeks of 2016, they have not been disappointed.

If precious metals miners and prospectors were looking for a series of dramatic events to usher in the first two weeks of 2016, they have not been disappointed.

Reserves and Resources Explained

February 2014

Reservers and resources are very important to prospectors and miners, but they may be vague terms to some.

Reservers and resources are very important to prospectors and miners, but they may be vague terms to some.

Reservers and resources are very important to prospectors and miners, but they may be vague terms to some.

Reservers and resources are very important to prospectors and miners, but they may be vague terms to some.

CFTC Finds Evidence of Silver Market Manipulation

December 2010

This is welcome news. Many silver market commentators have stated publicly that the price of silver, currently hovering around $23.50 per ounce, should be much higher due to the scarcity of supply and the lack of faith in fiat currencies such as the US Dollar.

This is welcome news. Many silver market commentators have stated publicly that the price of silver, currently hovering around $23.50 per ounce, should be much higher due to the scarcity of supply and the lack of faith in fiat currencies such as the US Dollar.

Subscription Required:

The Bawl Mill

• Our Readers Say

• Ask the Experts: What type of wetsuit do I need?

• Prospector's Guide to Rock Breaking and Blasting

• MMAC Update

• Pros and Cons of Big Detector Coils

• Prospecting and Mining Old Mine Sites

• Detecting Strategies for Heavily Forested Areas

• Mining Districts and Community Outreach

• Alaskan Gold Adventure

• Learning the Game and the Power to Change It

• Central Idaho Federal Employees Back to Work With Local Help

• Mining Stock Quotes and Mineral & Metal Prices