Money & Markets

Legitimately Reducing Business Vehicle Costs

May 2014 by Mark E. Battersby

When it comes to the expense of using a car, van, pickup or panel truck for business purposes, they can be deducted by the operation as 'transportation" expenses.Mining Stock Quotes and Mineral & Metal Prices

Mining Stock Quotes and Mineral & Metal Prices

Mining Stock Quotes & Mineral and Metal Prices

Mining Stock Quotes and Mineral & Metal Prices

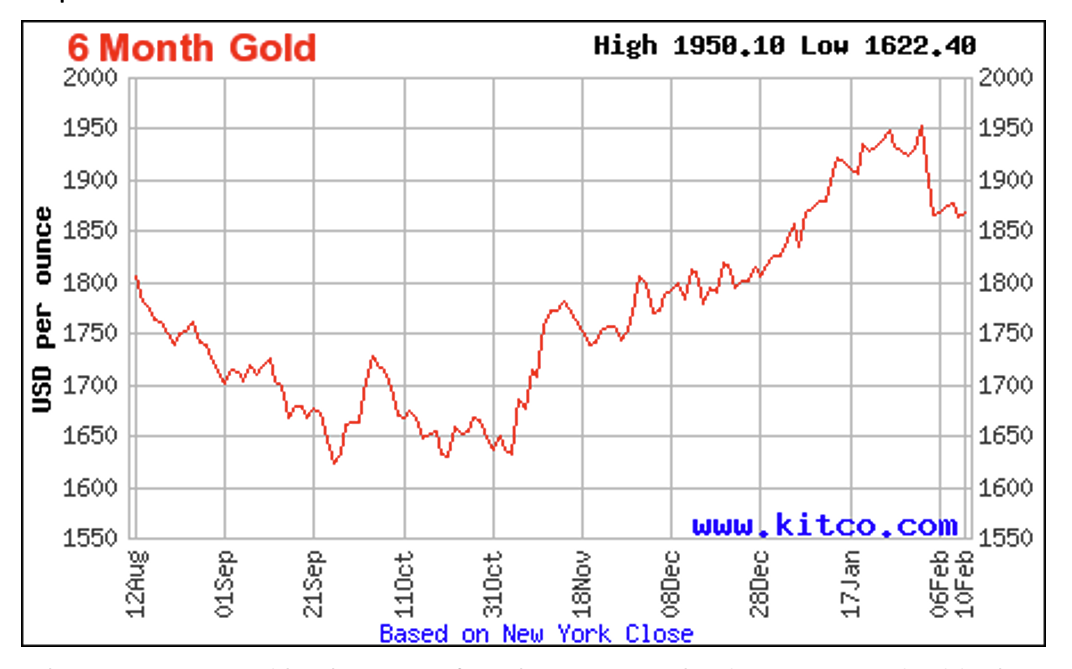

Melman on Gold & Silver

The last item on our “crisis agenda” may be the most important of all, perhaps because it may be the most unpredictable.

Subscription Required:

The Bawl Mill

• Ask the Experts

• Ask the Experts

• Ask the Experts

• Ask the Experts

• Our Readers Say

• Gold Prospecting in Gatesville, Indiana

• Finding Gold with a VLF Detector—Part II

• Cliven Bundy vs. BLM

• Critical Metals: Zinc

• Search Coils and Techniques

• Round Mountain, Nevada

• Melman on Gold & Silver

• Mining Stock Quotes and Mineral & Metal Prices

• Scouts New Mining in Society Badge

Free:

Legislative and Regulatory Update

• Gold Prospecting & Mining Summit Exceeds Expectations