Large Scale Mining

Free / Large Scale Mining

Silver Bull Resources Sees Bright Future for Silver & Zinc

September 2013 by Leonard

Anyone who has visited northern Mexican cities such as Hermosillo and Torreon cannot help but be struck by the evidence of advancing prosperity such as modern shopping centers, attractive housing areas, increasing traffic flows and a lively night life. Unquestionably, mining has been making an important contribution to this growth and, therefore, the Mexican government is clearly committed to helping the industry in any reasonable way.

One company taking advantage of this situation is Silver Bull Resources, Inc., a Vancouver-based junior miner currently working diligently to advance their silver/zinc Sierra Mojada Project located in the northern Mexican  state of Coahuila. The company operates in Mexico through their wholly-owned affiliate, Minera Metalin S.A. de C.V.

state of Coahuila. The company operates in Mexico through their wholly-owned affiliate, Minera Metalin S.A. de C.V.

Your correspondent, accompanied by several journalists, analysts and newsletter writers, visited Sierra Mojada in late spring for an extensive visit, both above ground and underground. We were also able to engage in discussions with company management and geologists as well as personally inspect company facilities, trench exploration diggings and the extensive underground silver and zinc ore bodies.

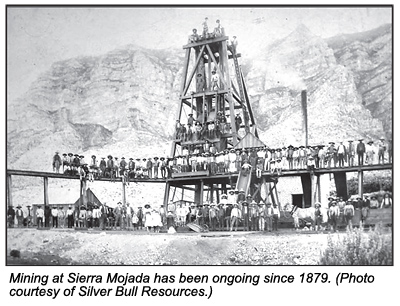

The Sierra Mojada Project lies within a historic high grade silver, lead and zinc mining district originally discovered in 1879. The project is 100% owned and operated by Silver Bull and is part of a land package totalling 52,305 acres ( 21,167 hectares) consisting of 40 mining concessions overall and is located approximately 150 miles (250 kilometers) north of Torreon, an important metropolitan area with a regional population of well over 1,000,000 people.

Area infrastructure near the project is excellent with paved roads from Torreon leading directly to Sierra Mojada, an active rail line servicing the area, grid power availability and five company-owned water wells. The local population provides an experienced workforce as many area residents have gained mining experience at the nearby Penoles Mina Dolomita, a dolomite extraction and crushing facility. Major mining equipment, supplies and services are available from Torreon, about a three-hour drive by auto or truck. An airfield is located close to the mine, but it requires some upgrading.

The project area’s climate is arid and warm, allowing for year-round operations. Although the annual rainfall total is quite small, there is a distinct rainy season, lasting from June through October, that helps moderate high summer temperatures, with the highest yearly temps typically being reached in May. Freezing temperatures are rarely recorded and snowfall is minimal.

The Sierra Mojada project hosts several mineralized areas and has a lengthy mining history dating back to the latter part of the nineteenth century when prospecting was conducted by locating ore outcroppings. By the 1920s, diamond drilling was widely used in the district, and subsurface exploration and development included workings and drifting on structures. Underground diamond drilling was widely used beginning in the 1930s through the 1990s.

The Sierra Mojada project hosts several mineralized areas and has a lengthy mining history dating back to the latter part of the nineteenth century when prospecting was conducted by locating ore outcroppings. By the 1920s, diamond drilling was widely used in the district, and subsurface exploration and development included workings and drifting on structures. Underground diamond drilling was widely used beginning in the 1930s through the 1990s.

From 1995 forward, various exploration and development works were performed at Sierra Mojada by companies such as Metalline Mining, USMX, Rio Tinto and Penoles. These works included driving raises through the oxide zinc manto, conducting underground exploration, extensive drill programs and channel sampling.

Following the termination of joint venture agreements, Metalline Mining retained ownership of Sierra Mojada and in 2010 merged with Dome Ventures while retaining the company name, which was subsequently changed in 2011 to Silver Bull Resources. Silver Bull then continued diamond drill exploration until March, 2013.

During the project’s history, several significant drilling programs have taken place amounting to a relatively huge sum of 169,000 meters comprised of 123,000 meters of surface drilling; 6,600 meters of underground drilling and 40,000 meters of historic long hole drilling. This historic body of information, along with trenching, sampling and various geophysical programs, was instrumental in providing sufficient information for the company to release a NI 43-101 qualified Technical Report on Sierra Mojada. Included is a silver resource estimate using a cut-off grade of 25 grams per tonne (g/t) of 72,914,248 tonnes grading 69.5 g/t and amounting to 162.9 million ounces Ag. Zinc resources amounted to 2.411 billion pounds grading 1.50%.

The regional geology for the Sierra Mojada district is composed of a well-preserved limestone-dolomite sequence sitting on top of red sandstones and older crystalline basement rocks.

The mineralization seen at Sierra Mojada is thought to be a Carbonate Replacement Deposit (CRD), a common style of mineralization in northern Mexico, and is responsible for some of the largest mines in Mexico, including the Niaca silver-lead-zinc mine operated by Penoles, and the Santa Eulalia silver-lead-mine mine operated by Grupo Mexico. CRD’s are formed via the intrusion of hot igneous rocks into the overlying limestone and “replacing” the carbonates with sulphides (hence the name “carbonate replacement” deposit). The  intrusive source or “engine” for the mineralization have both been found at Niaca and Santa Eulalia, but has yet to be located at Sierra Mojada, and provides a very interesting future exploration target for the project, as mineralization is often strongest in these systems immediately adjacent to the intrusive body.

intrusive source or “engine” for the mineralization have both been found at Niaca and Santa Eulalia, but has yet to be located at Sierra Mojada, and provides a very interesting future exploration target for the project, as mineralization is often strongest in these systems immediately adjacent to the intrusive body.

The company’s focus of attention is on the development of two distinct ore bodies, the “Shallow Silver Zone” (SSZ) and the “Zinc Zone.” Since the silver ore body lies above the zinc zone, the company plans to develop their silver ore body first and their zinc ore body later.

The Shallow Silver Zone is a near surface silver oxide zone composed of silver halides and secondary acanthite. Low-grade zinc, copper and lead also occur with the silver mineralization. It is a coherent ore body that has a present strike length of 3.8km, and is up to 200m wide and 140m thick. The mineralization remains open in the eastern, western and northern directions.

The company plans to mine the silver resources via an open-pit mining operation located at the thickest part of the SSZ and has developed a model “Mining Flow Sheet” including mining, crushing and grinding, VAT leaching, and the use of the Merrill-Crowe process to precipitate out silver and zinc.

One potential drawback to the Merrill-Crowe process is the cost of cyanide, but Silver Bull plans to address this problem by incorporating the SART cyanide recovery system, which allows for the regeneration of 98% of the cyanide used and the recovery of up to 50% of the low-grade zinc that occurs with the silver mineralization that was previously thought unrecoverable. SART (sulfidization, acidification, thickening, recycling) not only allows for significant savings in the purchase of required cyanide, but also reduces other costs such as transportation, storage, etc.

In addition to the SSZ and the Zinc Zone, the company is also looking at two prospective areas within their holdings named “Dormidos” and “Palomas Negras.” Both of these areas have extensive historical underground and surface workings but have never been explored with modern techniques. However, some recent surface samples have provided encouraging returns such as up to 565 g/t Ag, 15.8% Zn and 11.2% Pb.

The company has completed extensive metallurgical test work at Sierra Mojada, conducted by Kappes, Cassidy & Associates (KCA) of Reno, Nevada. Much of the work analyzed samples from several silver deposit areas, and KCA also did extensive test work on the SART system. A summary of results of these efforts includes:

• An average silver recovery of 73.2% with peak values approximating 89%.

• Recovery of 40 to 50% of the low-grade zinc mineralization at the SART stage, previously thought unrecoverable.

• Greater than 98% recovery of cyanide through the SART system.

• The potential to optimize and improve silver recoveries to 75 to 80%.

The results also noted that silver recoveries generally improve with higher-grade ore; that silver recovery is grind-size sensitive with finer grinds allowing for higher percentage recoveries; and the degree of cyanide concentration is key to maximizing silver recovery.

The future appears bright in terms of demand for both silver and zinc. Silver, of course, is regarded as a monetary metal and therefore appeals to those seeking a hedge against some future monetary crisis, but it also is enjoying a resurgence in industrial demand for products such as reflective mirrors, batteries, photovoltaic cells, jewelry, medical devices and any product where electrical and temperature conductivity is a prime concern. Zinc’s most important uses involve galvanization of metal to prevent corrosion, as a medical powder, in castings and also paints, rubbers, pharmaceuticals and a host of other applications.

In addition to the company’s Mexican properties, Silver Bull also owns gold and manganese properties in Africa, but for the time being, their primary focus remains fixed on Sierra Mojada’s advancement.

Looking forward, the company plans to complete a Preliminary Economic Assessment on the Project during the Third Quarter 2013 and release a Feasibility Study in 2014.

_______________

Additional information is available via email from Matt Halloran at mhallaran@silverbullresources.com or online at www.silverbullresources.com

© ICMJ's Prospecting and Mining Journal, CMJ Inc.