All Articles

Free

Melman on Gold & Silver

August 2010 by Leonard

If there is one question plaguing the world of late, it relates to the question of how governments should proceed in order to restore economic stability and prosperity. Many of last month’s headlines dealt with exactly that issue.

The situation, of course, was brought front and center to the public’s attention by the recently concluded G-8 and G-20 conferences in late June hosted in Canada’s largest city, Toronto. The issue has taken on added timely importance because of the rapidly growing perception that all is not well economically in many nations, specifically including America.

Many news items coming out of the USA could truly be indicative of a dramatic slowing of the economy. The spectrum of economic information on residential real estate is weakening; auto sales are in decline; credit is becoming difficult to obtain; job growth is specious at best and downright discouraging at worst; and, in general, a consumer-driven new reign of prosperity has simply failed to materialize.

One side of the G-20 debates was led by President Obama and his team who strongly advocated retaining government stimulative programs, declaring that if they were suspended, a deep recession could emerge once again. On the other hand, many European nations expressed fears that monetary growth, national debts and budgetary deficits were running out of control and only a turn to austere measures would resolve the problems. We take a look at these classic differences below.

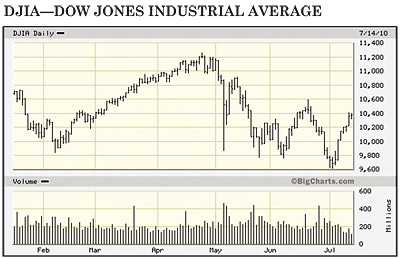

Stock markets are beginning to react to this unease, as evidenced by the recent performance of the Dow Industrials Index, which has fallen more than 10% since its late April peak (see chart).

Recent economic data truly took on a mostly negative aura of late. Wholesale Inventories combined with Wholesale Sales pointed toward future underlying weakness as Inventories rose in May over April by 0.5%, while Sales dropped in the same period by 0.3%. A combination of rising inventories and diminishing sales normally points to lower future orders and that is what happened, with Factory Orders dropping by 1.4% in May. New Auto Sales fell 11% between May and June while the Conference Board’s Consumer Confidence Index plunged from 62.5 in May to just 52.9 in June.

Jobs reports were also negative with the American economy shedding 125,000 jobs during June and the Institute for Supply Management’s indexes for the service sector and the manufacturing sector both showed moderate declines during June. Perhaps the worst array of numbers came from the residential real estate sector where virtually every important indicator fell last month, led by a decline in pending home sales for May of 30% from the April figure.

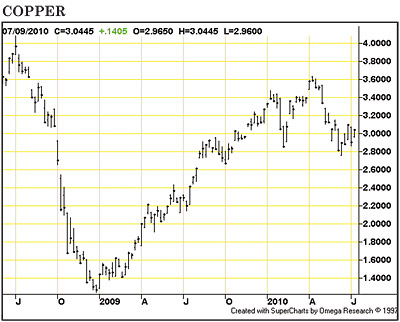

Gold had an unusual month, to put things mildly. First the yellow metal rose to a new all-time record high above $1,260 per ounce twice, both in mid and late June, before plunging by over eighty dollars to the $1,180 area—including one savage 45 dollar one-day drop—before recovering to near $1,200 at presstime. Silver followed a similar path, while the base metals were mostly unchanged last month. However, please note on the longer-term chart for copper that the major uptrend since late 2008 could be turning to the downside. Most stocks on our lists were little changed on balance during the month.

We realize the following commentary is longer than our usual contributions to this column, but we truly regard the potential impact of the environmental movement, combined with a favorable political background, to be one of the greatest threats to the future development of the base, precious and specialty metals mining community.

Every so often, events work to exacerbate an already difficult situation. In terms of the environmental community, one single event has served to galvanize their efforts to advance the potential for even more environmental regulations, even larger environmental bureaucracies and even more difficult public relations problems for the resource development industries to overcome. That event, of course, is the huge BP Gulf of Mexico oil spill, which began in late April, generated by the collapse of an oil development rig, and now affecting both the waters and the shorelines of that enormous body of water.

To say the media is obsessed with publicizing the potential damage to the region would be a vast understatement, and they are clearly using this “crisis” to enhance the likelihood of additional and more restrictive environmental regulations.

During our research for this article, it was impossible not to be stunned by the magnitude and powers of the environmental movement as well as the differing manners in which they influence both the media and the political systems in America, Canada, and around the world. Here are several of their techniques.

- Petition governments for funds.

- Exaggerate the possible harm of any pro-mining activities.

- Work in unison with other organizations of similar ideology.

- Open the legal and regulatory doors for challenges to resource development from as many directions as possible.

- Attempt to reverse permits that have already been granted.

- Place enormous pressure on end-users, such as jewelry companies, to denounce the metals produced from projects that environmentalists claim might be “dirty.”

The complexity and growth of the international environmental community is staggering as major environmental organizations now exist in virtually every nation on this planet, and they exist in abundance. Simply listing (one line each) these organizations takes sixteen printed pages, each one with their own website and most with their own legal staffs. In Canada, nineteen separate organizations are listed and for the UK, that number swells to 34. However, the USA figure dwarfs both of them combined with at least 81! And, many of these are

“umbrella” organizations with sub-chapters and sub-sections, always working toward advancing their goals.

“umbrella” organizations with sub-chapters and sub-sections, always working toward advancing their goals.One such aim is to infiltrate the education system and thereby insure that our children and grandchildren become thoroughly indoctrinated with the environmental point of view. Under the category of “Environmental groups and resources serving K-12 schools” we located thirty-seven specific groups whose purpose was to interact with education systems in the USA, Canada and internationally to advocate for environmentalism within their national school systems.

A personal story illustrates just how effective they can be at convincing our youth regarding supposed harm resource development inflicts on society. During a recent convention in Spokane, Washington, we listened to a resource development advocate describe a meeting with a forester friend. The friend told him that upon returning home one day, his grade school daughter looked up at him with a sad, mournful face and asked him, “Daddy, how many trees did you kill today?” Not how many homes he helped build, not how much furniture might be manufactured from the wood he helped provide or how much paper would be made available to the publishing world, but only how many trees he had killed.

Those young people are growing up and will soon be in the electorate or in the halls of political power—or both. They are not going away and we believe their future ability to interfere with mining and prospecting, forestry, energy development, fisheries and even agriculture can only get worse.

Paul H. Rubin, Professor of Economics at Emory University, recently wrote an op-ed piece for the Wall Street Journal headlined, “Environmentalism as Religion.” The thrust of his article was that for many environmentalists, the movement has become their new religion, replete with holy days such as “Earth Day;” food taboos such as excessive meat consumption; self-sacrificing rituals such as recycling; complete belief systems; and even sacred structures such as a vast number of recycling bins—and woe betide anyone who does not use them! With some irony, Rubin points out, “While people have worshipped many things, we may be the first to build shrines to garbage.”

He also writes that those who do not buy into their entire program are “treated as evil sinners.”

This is a powerful, dedicated and fanatical force that is growing by leaps and bounds, continually gaining political and regulatory powers. Mining executives who blind themselves to the possible negative impacts of environmentalism on the world of precious, base and specialty metals mining could be open for some very unfortunate lessons. The situation is difficult and growing more perilous for the industry with each generation.

Our advice is be prepared, learn as much as possible regarding this threat, and support those organizations that are attempting to educate the public regarding the absolutely essential nature of mining to the continuation of society as we know it.

A classic battle among economists has been raging for decades and is most personally personified by two giant figures, Lord John Maynard Keynes and Friedrich A Hayek. Keynes is the favored authority on government intervention to correct major economic problems while Hayek, a Nobel Economics Prize winner, is most closely associated with limited government, hard money and a relentless defense of both individual liberty and free markets.

By coincidence, noted economist Richard Ebeling, Professor of Economics at Northwood University, just published a series of letters to the editor of the Times of London, written by both Keynes and Hayek—and their associates—in the 1930s, elaborating on already-recognized positions.

In the Keynes group missive of October 17, 1932, Keynes wrote that the “...private economy was the culprit that impeded a return to prosperity.” One of the bases of his argument was that there was no certainty that funds acquired privately would be invested constructively in the economy-at-large, but when money was distributed by government then such certainty could take place. Ergo, government spending was infinitely superior to private accumulation of capital.

Hayek and his associated professors replied to the same publication on October 19, 1932. While they agreed with Keynes on the goal of increasing overall participation in the economy, they provided two reasons why they felt government should not be the primary factor in such participation.

Their first reason was a preference for securities markets and bank lending as the avenues for such activities and second, and perhaps more important, they viewed government deficit financing with alarm. Their specific comment was, “The existence of public debt on a large scale imposes frictions and obstacles to readjustment very much greater than the frictions and obstacles imposed by private debt.”

It seems apparent that the Obama Administration clearly sides with the philosophical position of the Keynes group. Whether such strategies will bring about positive results remains highly debatable—and the precious metals markets are watching with great interest.

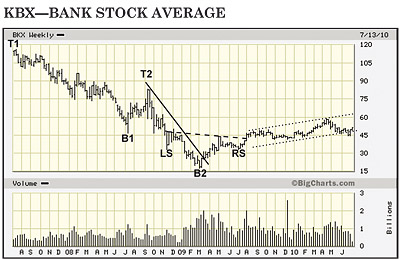

Chart Analysis—Bank Stock Average (BKX) 3 Years

The average then rebounded sharply, perhaps in reaction to the first giant Bush stimulative program and recovered to a second peak at 83 (T2), a gain of 37 points from B1—or exactly half the preceding decline. As the home industry began to collapse, BKX fell spectacularly, finally bottoming at 16 (B2). It is worth noting the percentage decline from 120 to 16 was almost identical to the Dow Industrials decline from 384 to 41 during the Great Depression!

Starting in March 2009, the Obama Administration began to pull out all the stops to stimulate business activity and the BKX managed to rebound, formed a “head and shoulders” bottom at LS, B2 and RS, and finally rose above its “neckline” indicated by the dashed line.

In terms of chart theory, when the BKX rose above its neckline, it should have advanced sharply to the region of 75, but it has failed to do so. In fact, trading since summer 2009 has been confined to a shallow rising channel (dotted lines) and BKX appears to be in the process of falling below that channel at present.

Given the enormous level of economic stimulation that has been provided, it is a matter of serious concern that all the BKX has managed is a relatively weak rally, from which it now appears to be failing. Any decline in the near future below support between 42-45 would be a potential warning sign that the present recovery may be petering out, if you could call it a recovery in the first place.

Our “World of Gold” indicators are as follows:

(Note: A “Positive” rating means the situation is beneficial for precious metal prices.)

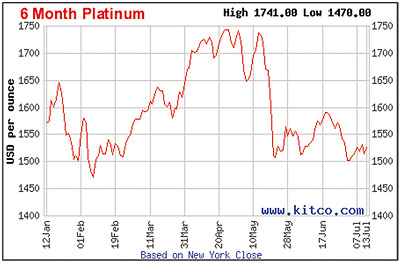

INFLATION—Remains NEGATIVE. There are simply no present signs of visible price inflation. In fact, the latest series of Dow Jones—UBS commodity indicators shows prices on seven of nine categories to be down for the year to date.

INTEREST RATES—Remains NEGATIVE. Short-term rates have remained fixed near “zero” for many months and long-term, 30-year rates have now fallen to near four percent, down from close to five percent late last year.

INTERNATIONAL TEMPERATURE—Remains POSITIVE. A series of potential land mines exist out there from Israel-Palestine to Iranian nuclear weaponry to South Korea versus North Korea to murder and rioting in Pakistan. Each one has the potential to explode in magnitude.

US DOLLAR—Changes to NEUTRAL. The US Dollar has come under some serious selling pressure in recent weeks and the DXY Index (see chart) has fallen from above 88 to barely 84, a significant short-term change to the downside.

US ECONOMIC TEMPERATURE—Remains POSITIVE. With the publication of a host of negative economic statistics, pressure for the US to continue heavy stimulative measures remains a major factor.

US POLITICAL CONFIDENCE—Remains POSITIVE. Ratings for the Obama Administration have descended to the point where the November election could result in a House majority for the Republicans, which would leave a split, deadlocked Congress going forward.

WORLD’S STOCK MARKETS —Remains POSITIVE. All major world securities markets have now fallen more than 10% below their yearly highs, the generally accepted measurement of a bear market. Investor confidence worldwide has been diminishing of late.

GOLD’S TECHNICAL POSITION—Remains POSITIVE. While the short-term chart has entered a trading range following gold’s sharp one-day decline early this month, both intermediate and long-term trends remain solidly bullish.

TOTAL SCORE—Positive, 5; Neutral, 1; Negative, 2.

Final Thoughts:

While other subjects might seem important, we are growing increasingly concerned with the outcome of the onrushing November off-year elections. A most interesting article suggests what might occur should the results be a strong Republican victory, particularly one where the Democrats lose their majority in the House of Representatives. We consider the concepts raised by that article to be of vital concern and plan to deal with them next month.

In addition, a most interesting regulatory event relating to mining took place in British Columbia recently. It reflects many of the points raised in this month’s environmental article and, space permitting, we will discuss that event as well.

Until next month, happy prospecting and enjoy what is left of summer’s warmth.

© ICMJ's Prospecting and Mining Journal, CMJ Inc.