All Articles

Free

Melman on Gold & Silver

October 2009 by Leonard

During the past month, government actions took front and center stage so often that they crowded out virtually every other consideration. And, most important of all, it seemed to appear that the American public was beginning to shout, “Enough is enough,” as President Obama’s approval ratings headed downward with a vengeance with less than fifty percent of the population now giving him a solid approval rating.

Among the President’s actions last month was the confirmation of Ben Bernanke for another term as Fed Chief, pointing the way to a continuation of the stimulative and rescue policies of the past year that have added so dramatically to the nation’s debt and deficit numbers. Also, the President delivered a major address to Congress declaring he still believed in an overhaul of America’s medical insurance system, another indication of continuing government interference in social and financial matters.

It wasn’t only the Federal government that made headlines. Many states announced that they were in desperate shape and began to declare a series of cost-cutting measures, from closure of some correction facilities in Michigan, to early release of marginal prisoners and furloughs of state workers for specified periods in California. The situation has reached a point where citizens in many states are now calling for constitutional conventions to require state governments across America to function according to rules of fiscal sanity as a matter of constitutional law.

So many problems appeared on the horizons this past month that it’s difficult to list them all. One of particular interest, because it threatens to undermine entire systems of government, is the rapid aging of various populations (see below). The scope of the problem can be well demonstrated by the fact that in 1950 there were only a few thousand centenarians on Earth, but that number is more than one-third of a million now and is expected to grow to over six million by 2050 with the number in America expected to rise from today’s 67,000 to over 600,000 by mid-century.

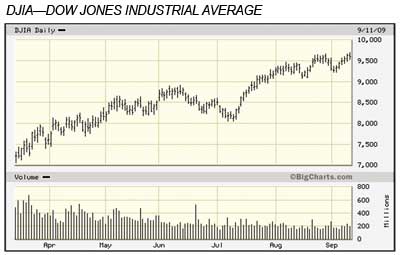

Despite numerous financial problems, securities markets continued to rise and the Dow Jones Industrial Average kept creeping closer to the 10,000 level by passing through 9,600 this past month (see chart). There is a great, ongoing debate between those who consider the rally from March’s low of 6,400 to present levels to be the onset of a great and sustainable bull market and those who consider that move to be just a major rally inside a powerful and continuing bear market.

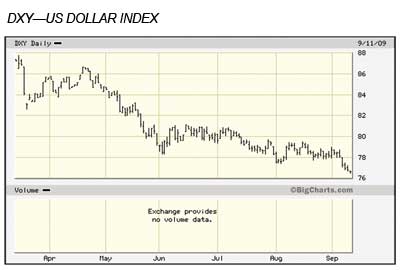

Another note worth discussing is the US Dollar, which plunged to its lowest level of the year by mid-September, with the DX Index falling below the 77 level, far beneath its yearly high of 90. This rapid decline, combined with the horrendous state of many of the nation’s account books, is causing observers around the world to wonder if the Greenback’s days as the world reserve currency are now numbered (see below).

We cannot help but pause to also remember Senator Ted Kennedy, whose passing marks the end of well over one-half century of public attention being centered on the Kennedy clan, from President John F. Kennedy to Senators Bobby and Ted. They occupied a powerful position to the left side of American politics and whether one agreed or disagreed with their fundamental position, their influence could hardly be denied.

Economic data continued to point to the negative, but there were some optimistic notes. On the plus side, Consumer Confidence readings improved with the University of Michigan Consumer Confidence Index rising from 65.7 in August to 70.2 in September. Construction of single-family units rose a modest 1.7% in July after climbing a strong 17.8% in June and car sales, benefiting from the Cash for Clunkers program, rose to their highest levels in more than one year in August.

However, there was still plenty of negative data, highlighted by the continuing losses on the labor front, with particular attention being paid to the Unemployment Rate, which hit 9.7% in August. Teenage Unemployment surged past 25%, the highest rate on record, even surpassing the Great Depression. Even worse, the outlook for fourth quarter 2009 hiring plans reached the lowest levels ever recorded in Manpower Employment’s Outlook Survey history going back to 1962. Mortgage delinquencies continued to rise last month as did foreclosure notices.

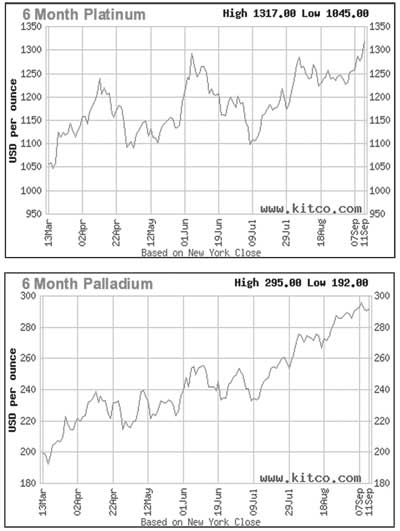

One source of positive headlines was the price of the metals at presstime, particularly gold and silver, which reached highs of $1,012 and $17.02 respectively; up solidly from the previous month and base metals also posted strong gains on balance. Mining share indexes broke sharply to the upside (see XAU chart) and, as might be expected, gains dominated our share listings with some companies showing truly spectacular upward moves.

_______________

For the past several years, foreign purchases of American governmental debt offerings have played an important role in maintaining America’s economic integrity. If those purchases should slow down or worse, become net sales, that could put immense pressure on both the strength of the US Dollar and the direction of interest rates.

One of the more interesting studies in which market analysts engage falls under the topic of “momentum studies,” meaning that not only is the analyst concerned with the actual factual data of an information series but the momentum relating to the changes of that data over a period of time. In this particular case, we are searching for clues to a direction of momentum in the “Foreign Holdings of US Debt.” A review of recent monthly data is most illuminating.

During the past two months, there has been a significant shift in the momentum of accumulation of US government debt by foreign holders. During the middle part of June, the annualized rate of growth in foreign holdings of such debt held by foreigners was about $445,000 greater than the year-earlier figure. By mid-September the increase was “only” $432,000 over the preceding year.

In other words, while the absolute number of dollars of US Government debt held by foreigners continues to increase, it is increasing at a reducing rate and, in our opinion, this could be significant, particularly because that declining rate is also coincident with a generally declining value of the US Dollar in currency markets. Please note that the “DX Index” of the American currency has just fallen to a multi-month low during the past two weeks.

This trend bears watching, and we will report on it periodically in future months.

_______________

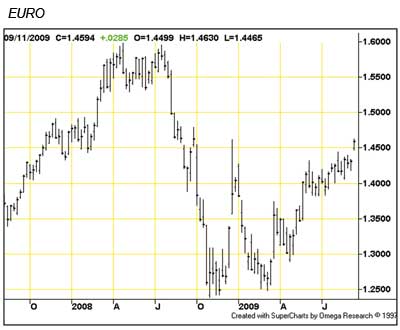

There was other important news relating to the Dollar as well. Of greatest concern, there was a growing chorus calling for the removal of the Greenback as the currency for international financial matters. The latest to chime in was a report from the United Nations Conference on Trade and Development in early September that boldly declared that the Dollar should be replaced by a global currency. They also proposed the greatest overhaul of the international currency system since the Bretton Woods conference following World War II.

The UN declaration followed shortly after a series of sharply worded warnings from the Chinese government that it was becoming truly alarmed at the rate of US money printing, which they believe could lead to serious troubles for the US currency, a matter of no small concern for China since government and private holdings of Dollars by Chinese citizens amounts to about four trillion dollars. One government representative, Cheng Si wei, was quoted by the London Telegraph as noting, “...If they keep printing money to buy bonds, it will lead to inflation, and after a year or two, the Dollar will fall hard... so we will diversify incremental reserves into Euros, Yen and other currencies.”

wei, was quoted by the London Telegraph as noting, “...If they keep printing money to buy bonds, it will lead to inflation, and after a year or two, the Dollar will fall hard... so we will diversify incremental reserves into Euros, Yen and other currencies.”

Even French President Sarcozy noted that the arrangements of Bretton Woods were under fire by stating, “What was true in 1945 can no longer be true today. The Dollar can no longer claim to be the only currency in the world.”

These comments and developments relating to the Greenback are of a much more serious nature than anything encountered in the recent past, and we cannot help but note that difficulties for the Dollar usually accrue to gold and silver’s benefit. Perhaps that is the strongest underlying reason for the recent powerful performance of those two metals.

_______________

Slowly, like a far-off gathering storm, we are beginning to hear more talk about the potential menace of hyperinflation. It is still a distant echo, barely even noticed by the vast multitudes in America and other industrialized nations, but we believe that gradually, over the coming months and years, the subject will finally reach the point of being debated by the public as a genuine possibility.

It is well worth noting that one country in the world, Zimbabwe, has just undergone the greatest monetary inflation in the history of mankind! This reality was brought to mind when a truly astonishing document was placed in our hands for comment. It was the annual report of a Zimbabwean bank holding company called “CBZ Holdings Ltd.” What intrigued us was the relationship between the figures printed in that annual report and the truly astonishing level of price inflation that has inundated that once-prosperous nation.

Just for the record, and because it applies to this discussion, here is the sequence of “giant” numbers, as documented by the National Institute of Standards and Technology, US Department of Commerce. In order of growing magnitude, they are; 1,000 billion = one trillion; 1,000 trillion = one quadrillion; 1,000 quadrillion = one quintillion; 1,000 quintillion = one sextillion; and 1,000 sextillion = one septillion. Believe it or not, all of these numbers are applicable to the annual report from the aforesaid Zimbabwean financial corporation.

The figure that really caught our eye was the “total assets” number, which amounted to $Z 5,467,558 quintillion. Extended to its proper form, that number reads, “5 septillion, 467 sextillion, 558 quintillion Zimbabwean Dollars! Were we talking about any other “reliable” currency, that figure might represent most of the wealth accumulated in the entire universe.

In the financial notes, even CBZ’s accountants had to take note of the following: “The official rate of inflation opened the year (2008) at 100,580%, and rose sharply to reach two hundred thirty million percent by July, 2008. Thereafter, no official figures were released by the Central Statistical Office.”

The havoc this kind of hyperinflation has inflicted on Zimbabwe can hardly be over-emphasized. What concerns us mightily when we notice the trillions of dollars of “stimulation” during the past year is that the United States of America appears to be taking the same kind of early measures that eventually led to Zimb abwe’s plight.

abwe’s plight.

_______________

Chart Analysis—Gold (Long Term)

The last time we reviewed the long-term chart of gold in this space was exactly one year ago in our October 2008 issue. At that time, our analysis of gold’s long-term chart suggested, “From a technical point of view, our answer is that the bull market remains intact...” As we take a renewed look at gold’s trading history, that prediction remains our viewpoint. In fact, we believe the situation has become even more bullish.

To review, gold hit its earlier spectacular peak near $870 in January, 1980 (P1), a peak that was followed by more than twenty years of lethargic performance, eventually reaching a new low just above $250 in 2001. From that point on, a major golden bull market developed, designated by the area to the right of the vertical dashed line.

Inside that bull market, gold has made two spectacular runs; from about $450 to near $730 in late 2005 to early 2006, and from near $650 to $1,030 from late 2007 through March, 2008. Each of those runs has been followed by a sharp drop. In the former case the decline was from $730 to about $550 and in the latter case from $1,030 to near $680. These declines are indicated as A1-A2 and B1-B2.

What is of particular interest is what happened when gold broke above its preceding high at A1 in November 2007. Within just four months, it had soared by 40% to $1,030. At the present time, gold has recovered virtually all the decline that bottomed at B2 and is within a hair’s breath of breaking above the March 2008 peak. The great question is whether breaking out into new historic high territory would lead to a massive and quick advance similar to the November 2007—March 2008 episode. If that is the case, then a rally to near $1,400—$1,500 could be anticipated.

In the meantime, gold’s chart is in bullish mode, rising above a long-term rising trendline dating back to 2005 and a shorter, steeper uptrend beginning in late 2008, both trends indicated by solid lines.

______________

The problem of aging populations in America, Japan, China and the rest of the industrialized world remains with us, although you would hardly know that there was any difficulty at all given the lack of discussion among the world’s economic leadership. However, these kinds of situations are gradually emerging into the bright light, and they are enormous, to say the least.

Social scientists have long believed that it takes a birth rate of about 2.0 children per adult woman to sustain a population over time and anything less than this will prove inadequate to maintain the population at an even keel. In much of the world, birth rates are far below that level and the consequences could be severe indeed. A simple recitation of some facts is most illuminating.

First, over the past few decades, workers have been retiring earlier, living longer and receiving larger retirement benefits. The draw on scarce resources therefore has been increasing steadily. Second, many of these benefits, such as Social Security, are provided by current taxes. Unfortunately, as the number of recipients has been rising, the number of new workers entering the roster of taxpayers has been diminishing and many economists now believe that a crunch time lies directly ahead as it is obvious the two trends, namely increasing benefits and decreasing contributors, cannot continue indefinitely.

Yet, there is no easy, politically palatable solution. The two most rational concepts would be to massively increase taxes on those who remain in the work force while another would be to either reduce benefits or extend the retirement age—or both—for those already retired or about to enter that blissful state.

The amounts involved are staggering, with some economists estimating future US government liabilities in excess of fifty trillion dollars. One can only wonder, with Congress already running huge deficits, exactly where the money is to come from. And, we are not talking about some distant period of little concern. The “Baby Boomers” generation is entering retirement by the millions, now, today and tomorrow. Just where the money is to come from to pay their Social Security, Medicare payments, pharmaceutical benefits and other government grants is yet another troubling, unanswered question.

We believe is yet another reason readers should consider some insurance positions in the precious metals.

_______________

Our “World of Gold” indicators are as follows:

(Note: A “Positive” rating means the situation is beneficial for precious metal prices.)

INFLATION—Remains NEUTRAL. Raw material prices continue to rise on balance and anecdotal evidence suggests that consumer prices are on the rise as well, despite the fact that government numbers continue to show little or no price inflation.

INTEREST RATES—Remains NEGATIVE. The Federal Reserve Board continues to hold to their policy of encouraging consumer activity by restraining short-term rates at their lowest levels in history, namely “zero,” while long-term rates continue to hold below 5%.

INTERNATIONAL TEMPERATURE—Remains NEUTRAL. While occasional car bombings and such continue to make headlines and other tensions boil beneath the surface, so to speak, there are few, if any, glaring examples of large-scale combat ongoing at the present time.

US DOLLAR—Remains POSITIVE. Not only is the Greenback steadily weakening, but calls for the abandonment of the US Dollar as the world’s reserve currency are growing more frequent and more strident.

US ECONOMIC TEMPERATURE—Remains POSITIVE. Tremendous problems continue to afflict the world’s economies in general and the American economy in particular. Unemployment rates are soaring, business failures are high, and future hiring plans are at the lowest ebb on record, foreclosures are rising, etc. All of these conditions strongly indicate the likelihood that financial authorities will continue to hold the money creation taps wide open for some time to come.

US POLITICAL CONFIDENCE —Remains NEUTRAL. As noted, the President’s poll ratings continue to decline and expressions of dissatisfaction with the tremendous expansion of government under his Administration are on the rise.

WORLD’S STOCK MARKETS —Remains NEUTRAL. While achieving short-term highs, most world markets remain far, far below the peaks of last summer.

GOLD’S TECHNICAL POSITION—Remains POSITIVE. All three trends, short-term, intermediate-term and long-term, are all bullish and the price of gold is now within about $20 per ounce of reaching the highest level in history.

TOTAL SCORE: Positive, 3; Neutral, 4; Negative, 1.

_______________

Final Thoughts:

As if there were not enough negative concepts to dwell on, yet another has begun to rear its ugly head, and it is one with enormous ramification toward human conduct. We are referring to the reality that many governments are simply running out of money, and in their desperation to raise funds, a bevy of new tax impositions are being created across America and around the world. Because taxes tend to increase expenditures while discouraging effort, these new taxes could be yet another drag on world economies at a time when we can ill afford such developments. We plan to look at this dilemma next month.

Until then, enjoy the brilliance of fall and Happy Prospecting!![]()

© ICMJ's Prospecting and Mining Journal, CMJ Inc.